Bitcoin price has been steadily rising, increasing by approximately 4% over the past 7 days. This trend reflects improved market sentiment and growing optimism among investors.

As momentum builds, key on-chain indicators suggest the possibility of a continued rally in the upcoming trading session.

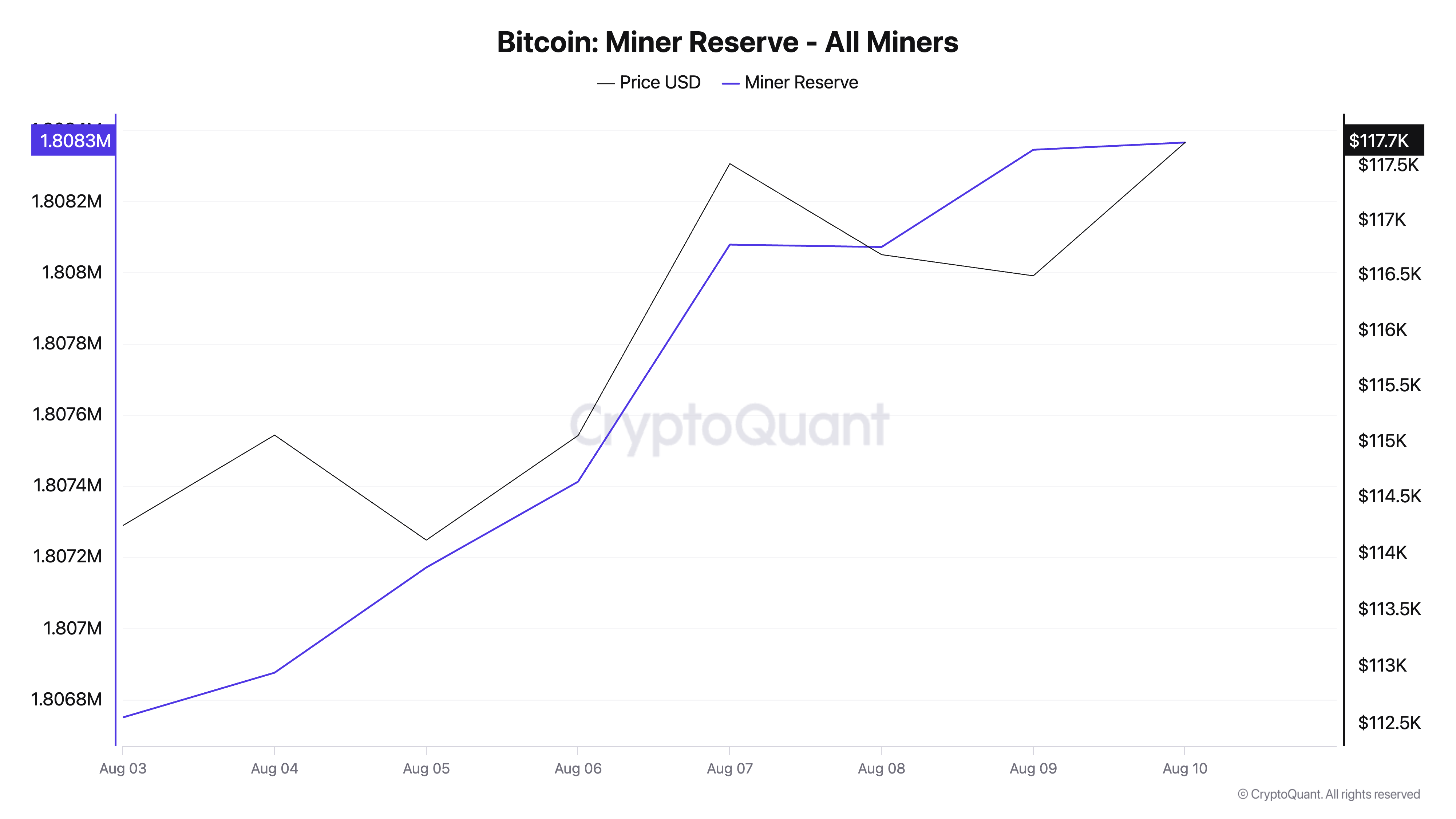

Bitcoin Miners Hold Steady

Bitcoin miners have begun accumulating coins again, with miner reserves reaching a weekly high of 1.8 million BTC.

If you want more such token insights, subscribe to the daily crypto newsletter by editor Harshi Notariya here.

Bitcoin miner reserves track the number of coins held in miner wallets, indicating the coins miners have not yet sold. A decrease in reserves often means miners are moving coins from their wallets to sell, signaling growing bearish sentiment towards BTC.

Conversely, an increase suggests miners are holding more mined coins, reflecting confidence in future price increases and a bullish outlook.

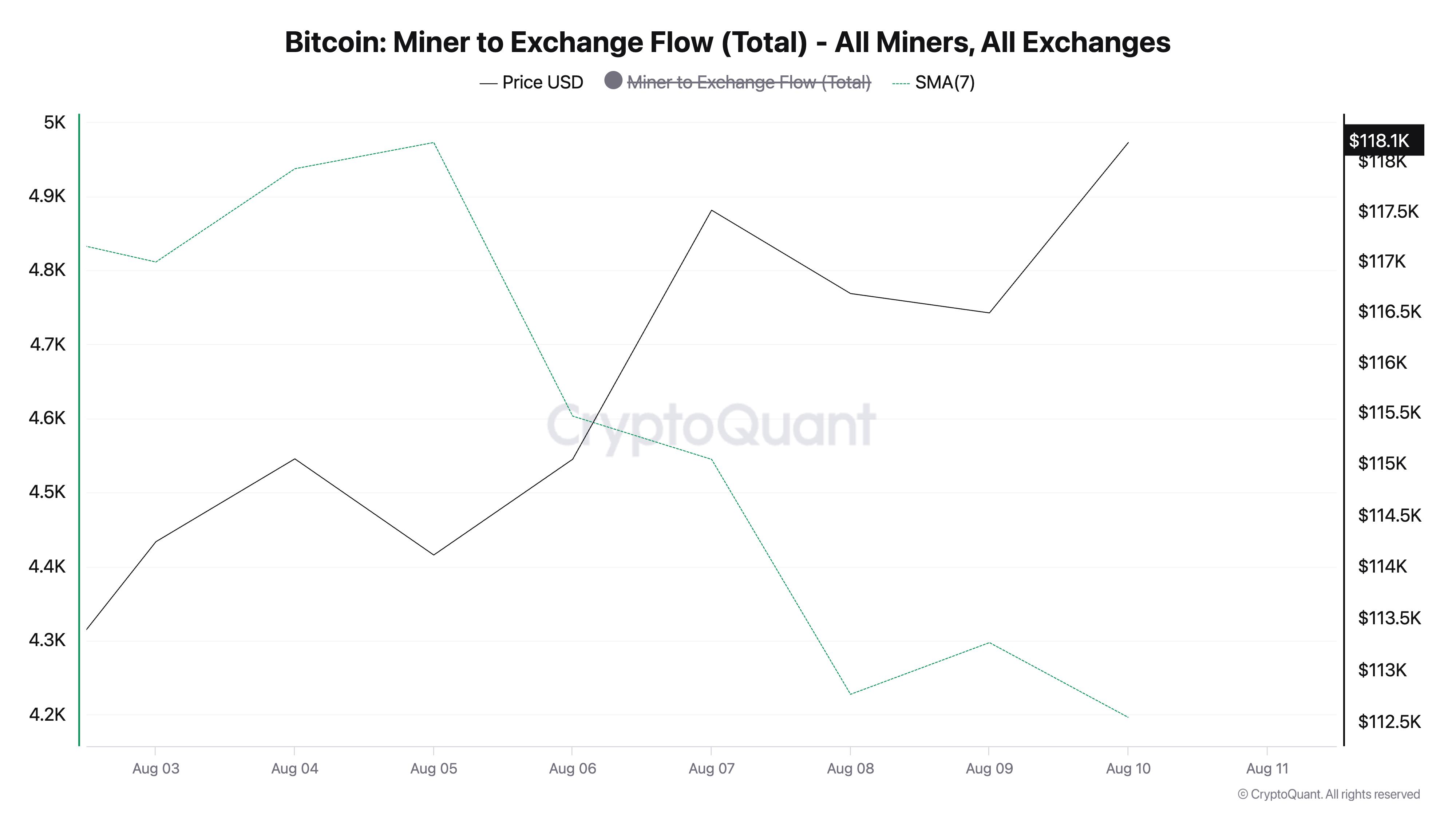

Additionally, the decrease in BTC miner-to-exchange inflows highlights the accumulation trend among miners over the past 7 days.

According to CryptoQuant, this indicator measures the total number of coins transferred from miner wallets to exchanges, which decreased by 10% during the period.

A decrease in BTC miner-to-exchange inflows indicates that miners are restraining sales and not bringing coins to exchanges. This reduces selling pressure and can boost confidence in BTC price and strengthen the rally.

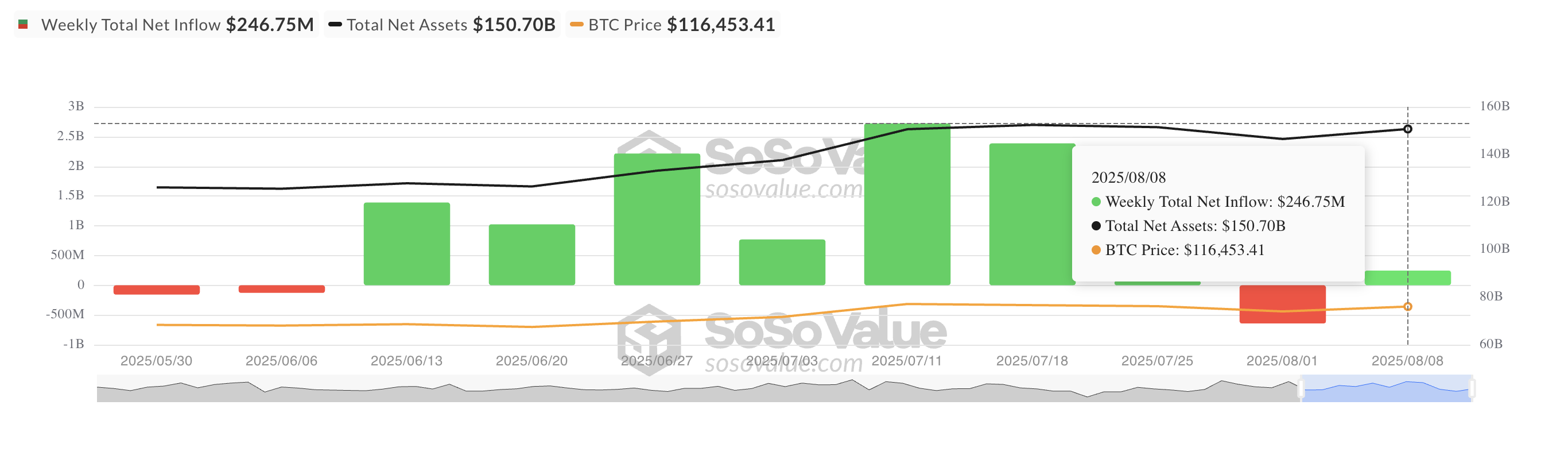

Moreover, weekly inflows into Bitcoin spot ETFs have turned positive, reversing the previous week's negative outflows. According to SosoValue, capital inflows into these funds reached $247 million from August 4 to 8.

This change indicates renewed buying interest from institutional investors and a shift in market bias towards BTC. Institutional investors are confident in the coin's continued upward trend and are increasing direct exposure through ETFs.

BTC to Surpass $118,851 and Reach $120,000?

The resumption of institutional demand and miners' confidence strengthens the possibility of BTC returning above $120,000 in the short term. However, it must first break through the resistance at $118,851.

Conversely, if accumulation stops, the coin could return to a downward trend and fall to $115,892.