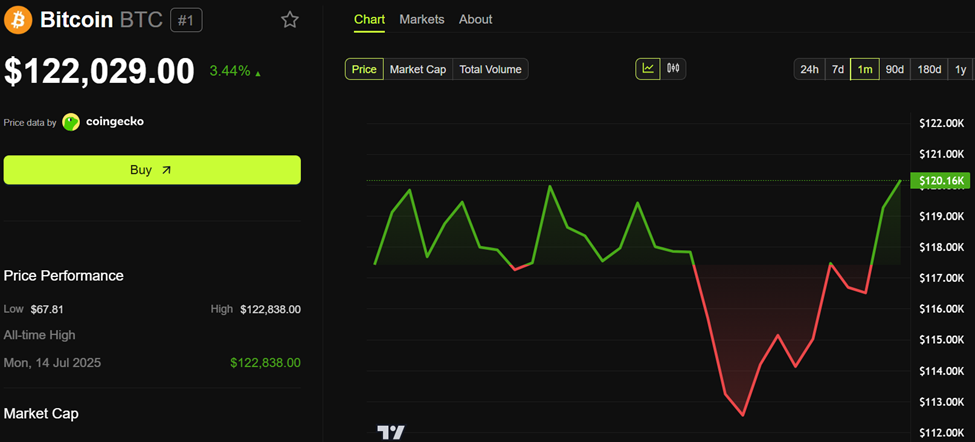

Bitcoin (BTC) price attempted to recover its recent high, surpassing $122,000. However, whether the rise will continue depends on several U.S. economic indicators to be announced this week.

Bitcoin is now accessible to both institutional and individual investors. U.S. economic data has a significant impact on this pioneering cryptocurrency.

U.S. Economic Indicators That May Hinder Bitcoin's Rise

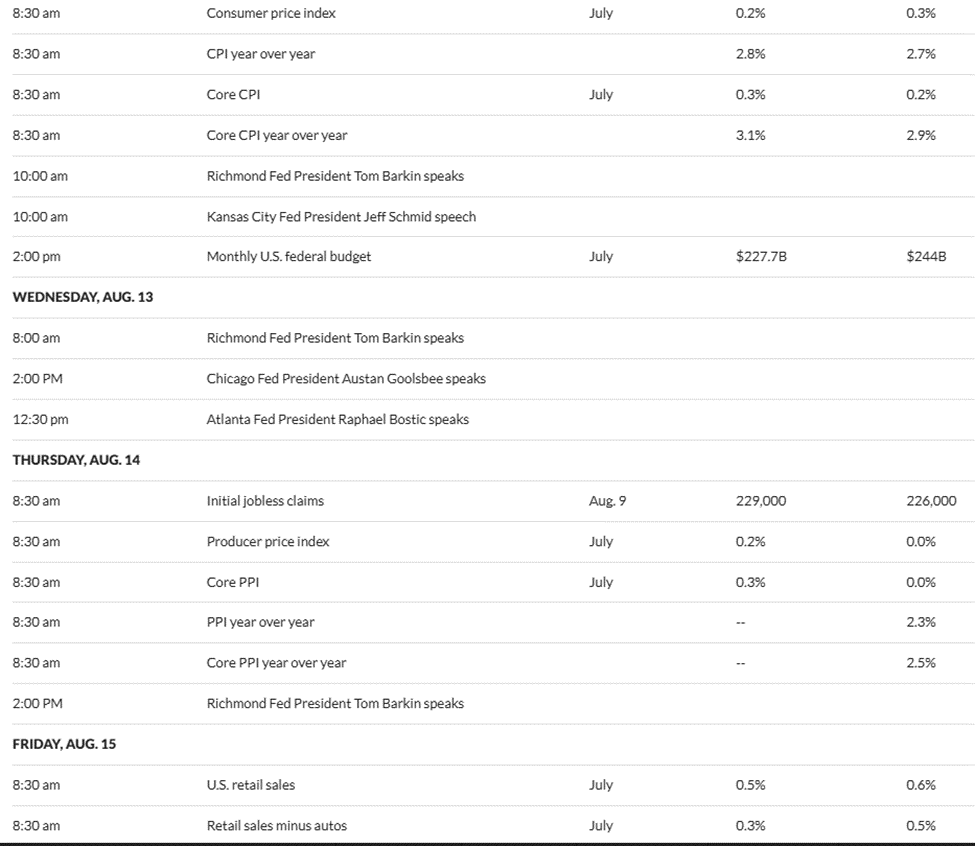

According to Marketwatch's data, several U.S. economic signals are scheduled this week, each with different market impacts.

CPI

The most important U.S. economic signal this week is the U.S. Consumer Price Index (CPI). It is scheduled to be announced on Tuesday, August 12. This data will determine the Federal Reserve's interest rate policy expectations.

According to the schedule data, economists expect the CPI to be 2.8%. This indicates that inflation rose in July compared to 2.7% recorded in June. Goldman Sachs also shares the same forecast.

This expectation came amid the Trump tariff issue that went into effect in another series on August 7.

"CPI inflation data will be released on Tuesday! The consensus among economists is that tariffs raised the July CPI." – Peter Tarr, Personal Investment Manager

A higher-than-expected figure, exceeding 2.8%, will strengthen the dollar and put downward pressure on Bitcoin prices.

However, if the U.S. Department of Labor announces a figure lower than June's 2.7%, it could trigger a cryptocurrency rally.

"After the recent unemployment rate data, the probability of a September rate cut is 91%. If the CPI comes in lower than expected, the September rate cut will be confirmed. This will further help the rally in risk assets. If the CPI is higher than expected, the probability of a rate cut will decrease, and cryptocurrency prices will fall. Recent unemployment rates have been rising, so the CPI is expected to be low, which will be positive for the market." – Analyst Bitbull

However, according to Tarr, investors are gradually incorporating the U.S. inflation increase into prices, which may not necessarily impact the market.

No. Not necessarily. Economists have done a pretty poor job thus far and the expectations of a slightly higher print are already baked in.

— Peter Tarr (@ProfitsTaken) August 10, 2025

It's nuanced. Will discuss.

PPI

Another U.S. economic signal this week is the Producer Price Index (PPI), scheduled to be announced on Thursday.

PPI is a key inflation indicator, and continued producer cost inflation could pressure the Fed to maintain its policy longer. This affects liquidity-sensitive assets like cryptocurrencies. Similar to the CPI, economists expect the PPI to increase after June's 2.3%.

"NFP bidding is being resolved in bonds. This week's core CPI and PPI are expected to be higher than previous figures. Why is this important? Because the market and the Fed will begin to realize that inflation risk is a greater risk than recession risk." – Capital Flows

Indeed, just as any CPI surprise could affect the Fed's rate cut, a rise in the U.S. PPI could fuel inflation concerns.

Retail Sales

Meanwhile, retail sales are also a major focus among this week's U.S. economic signals. Weak data could amplify recession concerns. The U.S. Census Bureau is set to release data reflecting consumer spending on Friday, August 15. This accounts for about 70% of the U.S. economy and impacts market sentiment.

After June's 0.6% figure, a Marketwatch survey of economists predicts a 0.5% figure for July 2025. These results indicate that U.S. consumer spending maintained strength but slightly cooled.

Particularly, a figure close to 0.5% is historically robust, suggesting the U.S. economy is still operating quite actively. The decline from 0.6% to 0.5% implies a slight cooling but is not sufficient to indicate a major demand reduction.

If retail sales exceed the 0.5% prediction, it could strengthen the strong economic narrative, raising yields and the dollar, but might create a short-term headwind for Bitcoin.

Conversely, if retail sales fall short of expectations, it could suggest the Fed might take a more dovish stance, which could be positive for Bitcoin and risk assets.

Initial Jobless Claims

Meanwhile, as the labor market's influence on Bitcoin and cryptocurrency markets grows, initial jobless claims will also be an important observation this week.

This economic indicator measures the number of U.S. citizens who first applied for unemployment insurance. Initial jobless claims were reported at 226,000 for the week ending August 2.

Continuing unemployment claims for the same week surged to the highest level since November 2021. For the week ending July 26, continuing claims increased by 38,000 to reach 1.97 million.

However, for last week, according to Marketwatch's data, economists predict a slight increase to 229,000. Meanwhile, market observers say this U.S. economic indicator has stabilized over the past few weeks.

Initial jobless claims have been stabilizing over the last few weeks.

— Eric Basmajian (@EPBResearch) August 7, 2025

Less so for the insured UR rate. pic.twitter.com/buXJu9Tsez

Stable but slightly increasing jobless claims suggest a cooling labor market. This could strengthen Fed rate cut bets and support Bitcoin's upward momentum.

At the time of writing, BTC is trading at $122,029, and has risen by 3.44% over the past 24 hours.