This week, there are not many new developments to report, as the S&P 500 index recovered from the impact of non-farm data and is approaching historical highs again. On the other hand, the Nasdaq index benefited from strong financial report performance, setting a new record, disregarding the ongoing political turmoil of the Trump administration and new import tariff issues.

Global risk assets also performed well, with European and Japanese stock markets rising due to ongoing trade resolution solutions, with the US making concessions on tariff stacking and automotive tax relief.

On the other hand, the US-China trade truce agreement is set to expire this week, with some market participants expecting the deadline to be extended again, but others are concerned that the US might impose new tariffs due to China purchasing Russian oil - previously, India was sanctioned for similar actions.

The good news is that the US and Russia plan to draft a new Ukraine peace agreement before this week's Alaska summit, providing another tailwind for risk assets and lowering oil prices as war premiums continue to fade.

US capital flows remain strong, with domestic and foreign investors returning en masse. The latest data shows that net purchases have set a new monthly inflow record, with trading volume also breaking new highs, forming a positive confirmation.

The US stock market trading volume in 2025 has reached a historical high, far exceeding previous years, mainly due to the strong return of retail trading since the beginning of the year. According to Citigroup data, the average daily trading volume in the first half of 2025 is nearly 50% higher than the average level of the previous five years, and has jumped 40% from the previous record set in 2024. This trend continued in July, with an average daily trading volume of 1.8 billion shares.

In fact, the performance in 2025 is so remarkable that 17 out of the 20 largest single-day trading volumes in history occurred in 2025, with 13 days in the second quarter alone. It's absolutely incredible.

Year-to-date, retail participation has driven extremely high stock concentration, with the top five stocks' trading volume accounting for over 20% of the total market volume on some trading days in 2025. Retail activity in call options has also rebounded significantly, reaching the highest level since the COVID-19 pandemic.

In terms of financial reports, about 80% of S&P 500 companies that have reported earnings have exceeded expectations, with a year-on-year growth of 12% and a 9% beat rate, led by technology and financial sectors. Against the backdrop of lowered expectations after tariff concerns, the second-quarter earnings per share significantly exceeded expectations in 2025.

The current rally has pushed the probability of an economic recession in the stock and credit markets back to single-digit lows. The US fixed income market remains an exception, as it continues to price in the most aggressive further easing by the Federal Reserve.

On the inflation front, although the Federal Reserve is willing to ignore recent price pressures, the ISM (Institute for Supply Management) sub-item data shows a worrying rebound in payment prices, which typically leads CPI by about a quarter and could trouble the Fed's rate cut plans later this year. However, currently, under the dominance of risk appetite sentiment, the market is happy to maintain its high position until hard data proves otherwise.

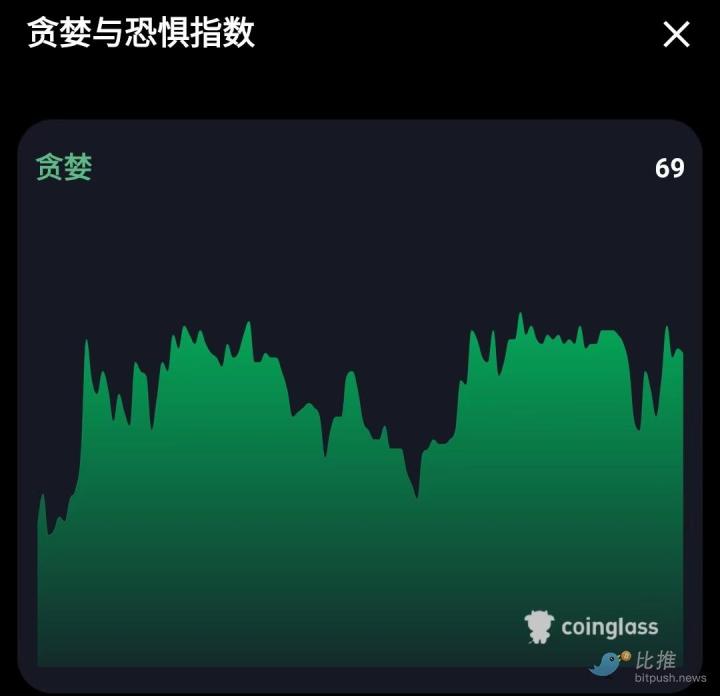

Cryptocurrencies also experienced a similar rebound this week, mainly driven by headlines about Trump ordering regulatory agencies to "research" the possibility of including cryptocurrencies (and private equity) in 401k investment portfolios. If this comes to fruition, it would obviously open up massive buying demand. However, there is still a long way to go before it could become law.

More excitingly, Ethereum led the weekly gains with a +20% increase. The latest mainstream experts/followers are hyping ETH as the newest FOMO target in the public equity field. Retail traders actively responded, pushing BNMR up nearly 60% this week, showing "native gamblers" how to properly FOMO in the regulated world.

As expected, the Ethereum ETF added approximately $700 million in inflows in the last two days of this week, pushing cumulative inflows to a new historical high, with assets under management growing twofold year-to-date to nearly $10 billion (vs. $3 billion at the beginning of the year).

ETH's recent rebound has also led to short-term volatility divergence, with Bitcoin's implied volatility still hovering near historical lows, while ETH's volatility has surged significantly. ETH's term structure is currently in contango, with long-term volatility expectations falling to around 70%, while BTC's IV curve is the opposite, with short-term volatility severely compressed, and spot market staying around $120,000.

For comparison, a month ago, the market only implied a 5% chance of ETH reaching $4,500 in August, but the actual spot market performance far exceeded the implied path, catching many participants off guard.

Looking ahead, at this point, we believe there is no strong necessity to chase the market high, as we expect market assets to experience two-way fluctuations in the next month or so. Be wary of potential downside catalysts such as a significant reversal of the US dollar index or unexpected inflation. Traders, please stay alert and have a successful trading experience!

Click to learn about BlockBeats job openings

Welcome to join BlockBeats official community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Communication Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia