Bitcoin (BTC) is attempting to recover its recent high, surpassing the threshold of 122,000 USD. However, whether the price increase will be sustained depends on several US economic indicators to be released this week.

With Bitcoin now in the hands of institutions and easily accessible to small retail investors, US economic data significantly impacts this pioneering cryptocurrency.

US Economic Indicators May Hinder Bitcoin's Rise This Week

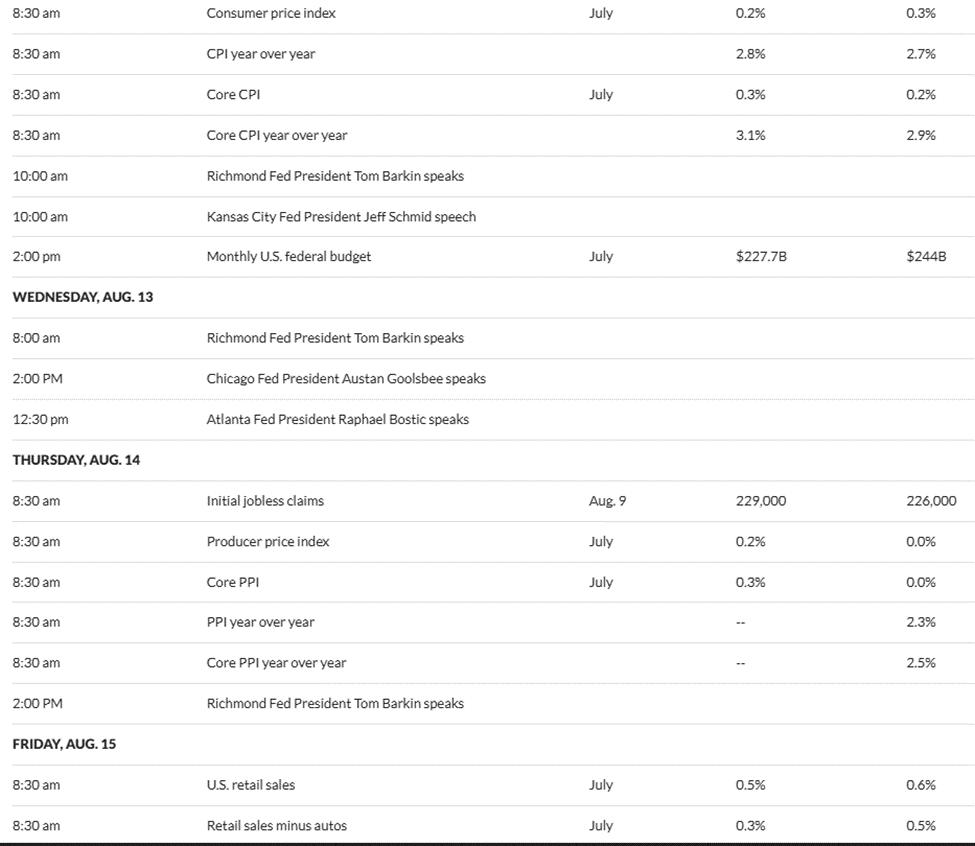

Data from MarketWatch shows several US economic signals scheduled this week, each with its own influence and impact on the market.

US Economic Signals This Week. Source: MarketWatch

US Economic Signals This Week. Source: MarketWatchCPI

The US Consumer Price Index (CPI) is likely the most important US economic signal this week. Expected to be released on Tuesday, August 12, 2025. This data affects the Federal Reserve's (Fed) interest rate policy expectations.

According to schedule data, economists forecast CPI will reach 2.8%, indicating inflation increased in July compared to the same period last year, compared to the 2.7% recorded in June. Goldman Sachs also made a similar forecast.

This forecast appears against the backdrop of Trump's tariff issues taking effect on August 7 for various products.

"CPI inflation data will be released on Tuesday! The consensus among economists is that tariffs have pushed July's CPI higher," wrote Peter Tarr, a private investment manager.

A higher-than-expected result, meaning any number above 2.8%, will strengthen the USD, putting downward pressure on Bitcoin.

However, if the US Department of Labor announces a lower number, such as below the 2.7% seen in June, it could stimulate a price increase for cryptocurrency.

"After recent unemployment data, the probability of a rate cut in September is 91%. If CPI is lower than expected, the September rate cut will be confirmed. This will help risky assets rise more strongly. If CPI is higher than expected, the probability of a rate cut will decrease along with cryptocurrency prices. As unemployment has recently increased, CPI is expected to be lower, which would be good for the market," wrote the BitBull analyst.

However, according to Tarr, this may not necessarily affect the market as investors gradually price in increasing US inflation.

PPI

Another US economic signal this week is the Producer Price Index (PPI), expected to be released on Thursday.

Notably, PPI is a leading inflation indicator, and persistent inflation in production costs could cause the Fed to maintain a tighter policy longer, affecting liquidity-sensitive assets like cryptocurrency. Similar to CPI, economists also forecast that PPI will increase from the 2.3% recorded in June.

"NFP is in the process of reversing as we enter a week where core CPI and PPI are expected to be higher than previous figures. Why is this important? Because the market and Fed will begin to realize that inflation risk is a greater risk than recession risk," said Capital Flows in a post.

Indeed, and like any CPI surprises affecting the Fed's rate cut, any increase in US PPI could raise inflation concerns.

Retail Sales

In another development, retail sales are also an important point in US economic signals this week, with weak data expected to increase recession concerns. The US Census Bureau is expected to release this data on Friday, August 15, reflecting consumer spending, which accounts for about 70% of the US economy and affects market sentiment.

After 0.6% in June, MarketWatch-reported economist polls predict 0.5% in July 2025. Such a result would show US consumer spending remains strong but has slightly decreased.

Notably, figures near 0.5% are historically robust, indicating the US economy is still operating hot enough to avoid spending decline. Although dropping from 0.6% to 0.5% suggests a slight decrease, it's not enough to signal a significant demand reduction.

Retail sales exceeding the 0.5% forecast will reinforce the strong economy narrative, potentially pushing yields and USD higher, but would be a short-term obstacle for Bitcoin.

Conversely, retail sales falling short of expectations would suggest the Fed might lean towards a more accommodative approach, which could be a positive signal for Bitcoin and risky assets.

Initial Unemployment Claims

Meanwhile, with the increasing influence of the labor market on Bitcoin and the cryptocurrency market in general, initial unemployment claims will also be an important point to watch this week.

This economic signal measures the number of US citizens filing for unemployment benefits for the first time in the previous week. Initial unemployment claims were reported at 226,000 for the week ending August 2.

In the same week, continuing unemployment claims rose to their highest level since November 2021, with continuing claims increasing by 38,000 to 1.97 million in the week ending July 26.

However, in the previous week, MarketWatch data showed economists predict a slight increase to 229,000. Meanwhile, market watchers indicate this US economic indicator has stabilized in recent weeks.

A stable but slightly increasing number of unemployment claims suggests the labor market is cooling, potentially driving Fed rate cut expectations and supporting Bitcoin's rise.

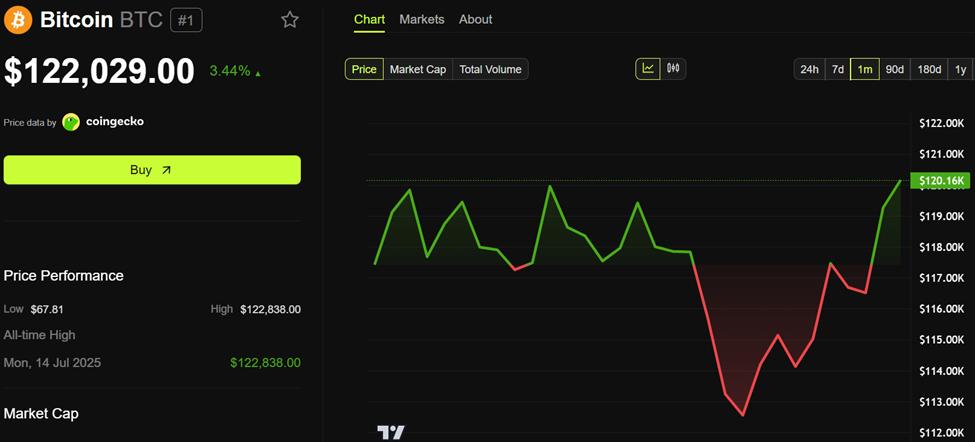

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCryptoAt the time of writing, BTC is trading at $122,029, up 3.44% in the past 24 hours.