Cryptocurrency inflows reversed the trend seen in the week ending August 2nd, reaching $578 million last week. Previously, Ethereum was leading, but Bitcoin is steadily catching up.

Trump's recent moves to include cryptocurrencies in US 401(k) were the main cause of the reversal witnessed this week.

Trump Triggers Crypto Inflow Recovery Mid-Week

For the week ending August 2nd, cryptocurrency inflows reached $223 million. This represents a notable contraction following the previous week's $2 billion.

However, Trump's recent moves to allow cryptocurrencies in US 401(k) triggered a sentiment reversal, pulling inflows up to $578 million.

"Extremely positive about cryptocurrencies!" said crypto analyst Lark Davis on X.

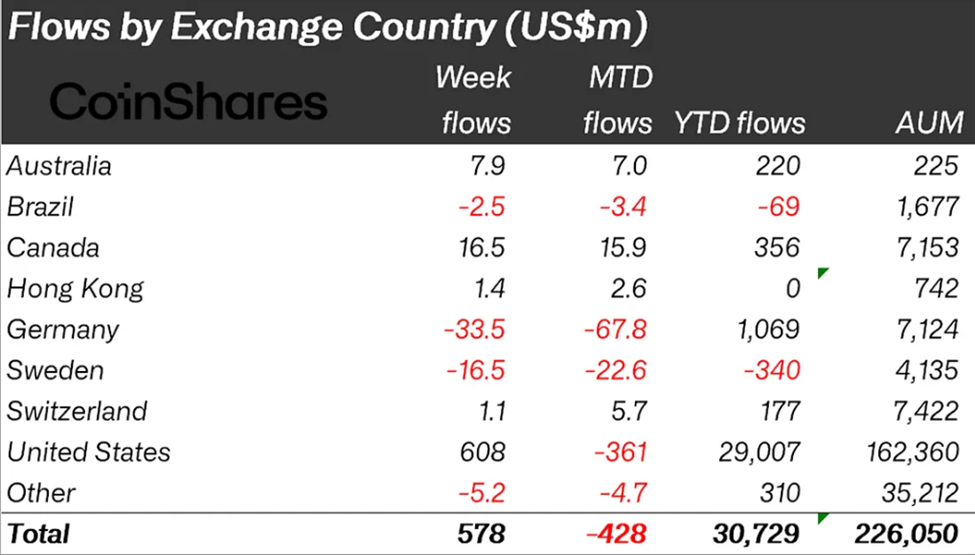

This indicates that high interest in inclusion outweighs negative sentiment due to FOMC and macroeconomic issues. The United States was the leader, accounting for most of last week's cryptocurrency inflows.

"Early week weak US employment data led to $1 billion in outflows, but after government 401(k) crypto approval, inflows rebounded to $1.57 billion, resulting in a weekly net inflow of $578 million," read an excerpt from the latest CoinShares report.

Specifically, Trump's guidance reversed cryptocurrency outflows that reached $1 billion mid-week due to negative US economic signals.

CoinShares' Research Head James Butterfill explained that the cryptocurrency market recorded a positive flow of $1.57 billion in the latter half of the week following the government's announcement.

However, cryptocurrency ETF trading Volume was 23% lower than the previous month due to the quiet summer period.

Bitcoin Chasing Ethereum

Meanwhile, Ethereum maintained a significant lead over Bitcoin in recent weeks amid an altcoin-led rally. According to BeInCrypto, Ethereum recently pulled cryptocurrency inflows to a weekly high of $4.39 billion.

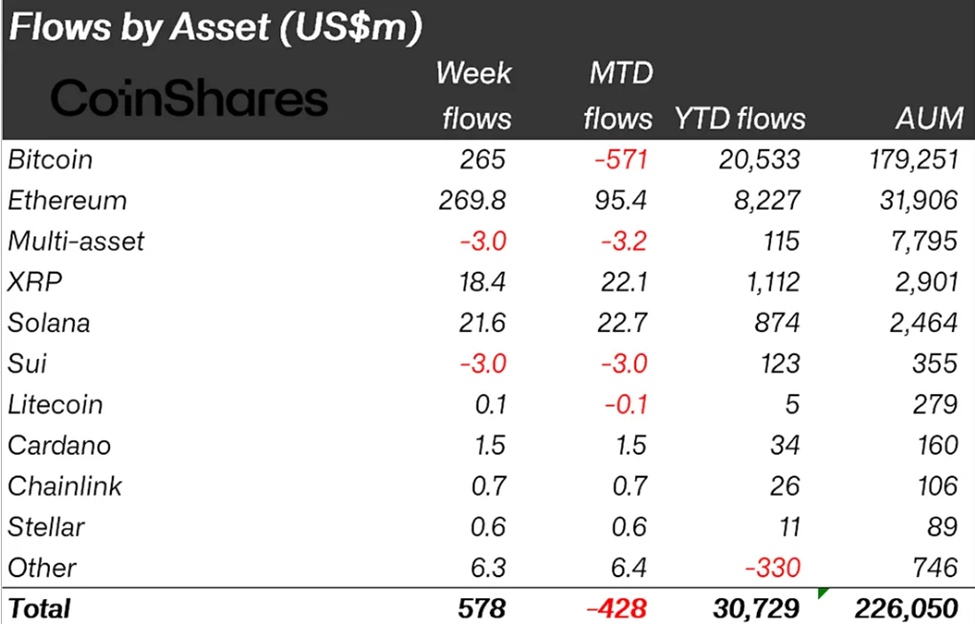

However, Bitcoin is catching up amid Trump's cryptocurrency push. Ethereum-related cryptocurrency inflows reached $269.8 million, with Bitcoin closely following at $265 million.

This represents a significant change from the previous week's positive flow of $133.9 million for Ethereum and $404 million outflow from Bitcoin investment products.

"Bitcoin showed recovery after two consecutive weeks of outflows," Butterfill wrote.

In this context, Jan3's CEO Samson Mow says most ETH holders have significant Bitcoin holdings through initial coin offerings (ICOs) or internal allocations.

The Jan3 executive suggests these ICO investors are transitioning to Ethereum, driving up prices and riding the Ethereum financial company narrative.

According to Mow, these investors will redirect funds back to Bitcoin once Ethereum price exceeds a certain level.

Aligning with Mow's perspective, Bitcoin pioneer Davinci Jeremy told his followers to leave just $1 to buy Bitcoin and urged investors not to sell Bitcoin for Ethereum.