XRP price rose by about 10% last week. The entire cryptocurrency market is riding the wave, surpassing $4.13 trillion.

However, this rise has attracted sellers, and on-chain data suggests that short-term holders may already be cashing out.

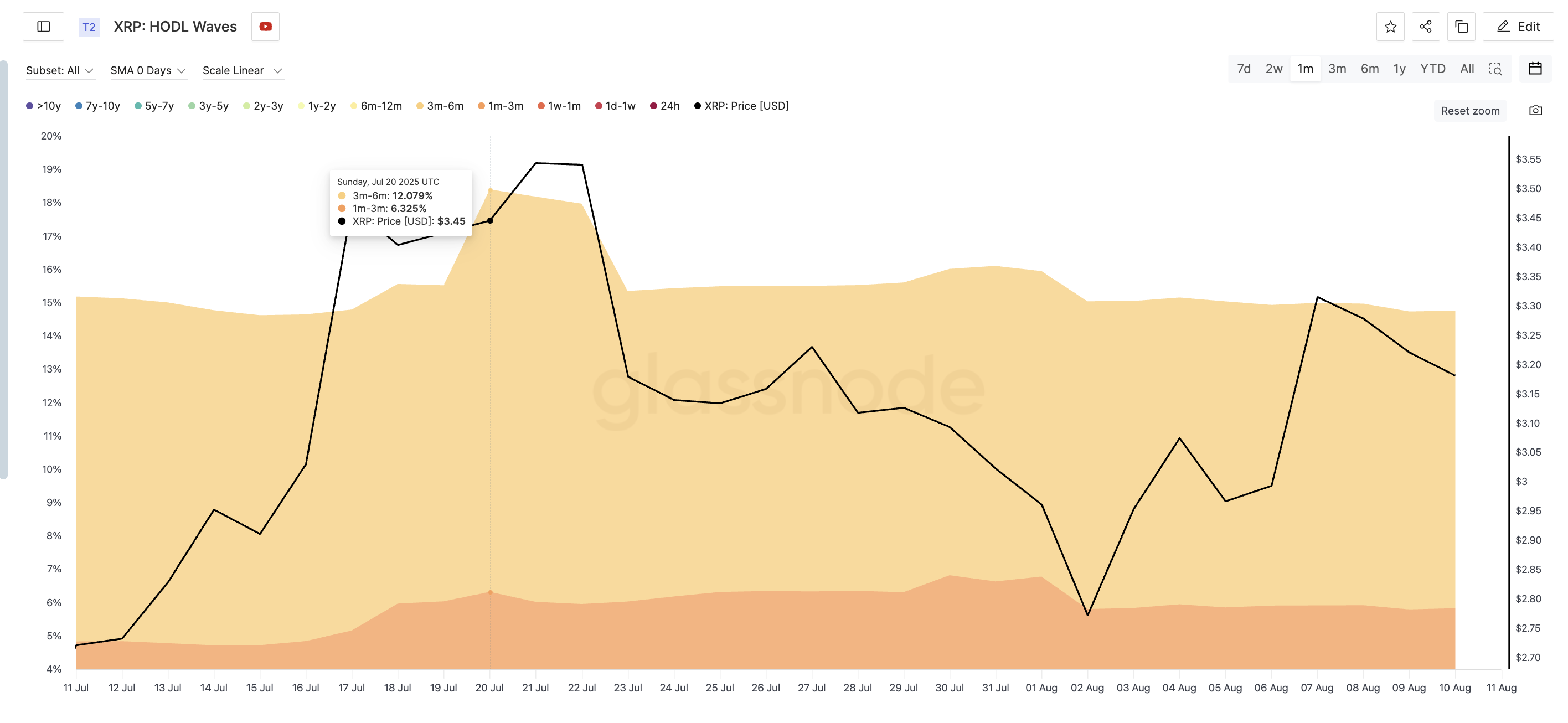

Short-term holders begin to exit

HODL Waves, an indicator that groups coins by holding period, shows that two major groups are rapidly shrinking.

On July 20, wallets holding XRP for 3-6 months controlled about 12.07% of the supply. By August 10, this figure decreased to 8.93%. The 1-3 month XRP wallet group tells a similar story, declining from 6.78% on August 1 to 5.83% at the time of writing.

The monthly accumulation of the 1-3 month group peaked when XRP price was around $2.77. As they continue to sell their stakes, the narrative of profit-seeking is clearly verified.

HODL Waves are important because they reveal investor behavior over time. The recent decrease in holder percentages means they are selling, often to lock in profits after a price increase. This can signal short-term sentiment changes before broader market trends shift.

Token TA and Market Update: Want more such token insights? Subscribe to the daily crypto newsletter by editor Harsh Notariya here.

Exchange reserves increase selling pressure

Connecting the HODL Wave decrease with exchange deposit data makes the situation clearer. XRP deposits on exchanges have increased over the past week. Historically, increased deposits and decreased short-term HODL groups have predicted price drops.

This pattern appeared on July 22 as well. Deposits surged and XRP price dropped from about $3.55 to $3.17 in one session. The logic is simple: coins moving to exchanges are easier to sell. When this happens with certain holder groups shrinking, it often means profit-taking is in progress.

XRP price structure still bullish

On the 4-hour chart, XRP price is still respecting the ascending triangle pattern. The bullish setup has notable clear levels. Resistance is at $3.34, and breaking through could open doors to $3.57 and the all-time high of $3.66.

On the downside, support holds at $3.15. Falling below that would activate $3.07, turning the short-term structure bearish.

For traders, the current hypothesis becomes invalidated if the price closes above $3.34. Until then, the mix of profit-taking signals and increasing exchange reserves suggests caution.

In summary, XRP's chart still supports bullishness, but short-term holder behavior and increasing deposits suggest momentum might pause before rising to new highs. Traders should watch $3.15 on the downside and $3.34 on the upside for the next big move.