As Bitcoin price rises again above $120,000, MicroStrategy and Trump Media are laying the groundwork for large-scale investments. The president's media company recently modified its Bitcoin ETF application in an SEC filing.

MicroStrategy made a relatively small purchase last week. However, following the large investment in the previous week, the company remains committed to continuously increasing its reserves.

Trump Media's Bitcoin Purchase Plan

After Trump allowed cryptocurrency investments in his retirement portfolio, Bitcoin has been surging. While there was already a global trend of corporate BTC acquisition, consumption is now being further encouraged.

Following this trend, Strategy (formerly MicroStrategy) and Trump Media have shown serious moves to increase their holdings:

Strategy has acquired 155 BTC for ~$18.0 million at ~$116,401 per bitcoin and has achieved BTC Yield of 25.0% YTD 2025. As of 8/10/2025, we hodl 628,946 $BTC acquired for ~$46.09 billion at ~$73,288 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/bx0814RI1w

— Michael Saylor (@saylor) August 11, 2025

Strategy posted impressive earnings last quarter, and its chairman Michael Saylor has encouraged investments in various altcoins. Compared to the large acquisition last week, the company's $18 million commitment seems relatively small.

While still showing steady progress, Trump Media is making a more significant impact with its announcement.

"Trump Media announced today that it has filed the first amendment to the registration statement for the Truth Social Bitcoin ETF with the (SEC). The ETF will directly hold Bitcoin and provide shares to investors, reflecting Bitcoin's price performance," the recent press release claimed.

Truth Social ETF, Surge in Demand?

When Bitcoin ETFs first emerged, they revolutionized the cryptocurrency market. Trump's business empire is now deeply integrated with cryptocurrencies, and his companies have recently started ETF strategies.

This includes dual BTC/ETH products and a 5-token basket ETF, but the Truth Social Bitcoin ETF is currently receiving the most attention.

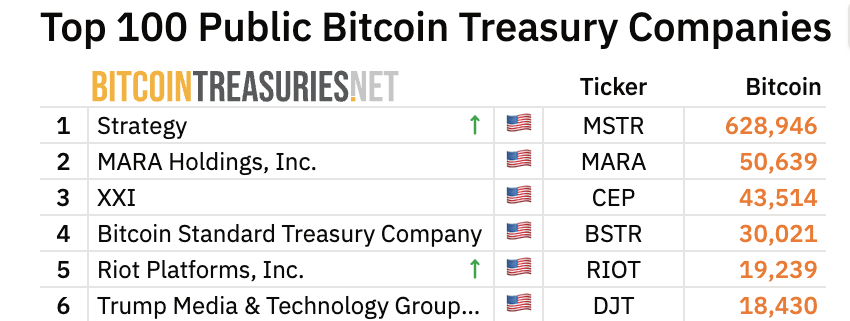

Moreover, while some other submissions have recently encountered regulatory obstacles, Bitcoin ETFs are a well-established market. To better prepare for this future offering, Trump Media has become the sixth-largest individual BTC holder, but still has a long way to go to surpass Strategy.

While Trump has already significantly impacted cryptocurrencies, the Trump brand ETF could trigger massive capital flows. Of course, the company can only sell ETFs based on its held assets, so Trump Media must continue purchasing.

Trump is setting many 'firsts' as a sitting president. This is unprecedented in his previous term, but now includes his private company directly applying for an ETF and cryptocurrency exposure.

However, given the current pro-cryptocurrency regulatory wave, such funds could be relatively easily approved.

In the short term, Trump Media will likely continue acquiring Bitcoin as quickly as Strategy. This demand is likely to impact BTC's price.