Welcome to the US Crypto News Morning Briefing. We'll briefly summarize today's key cryptocurrency highlights.

The financial market is sending warning signals similar to those before the largest collapse in modern history. Bitcoin (BTC) is now trading above $120,000, with analysts and traders debating whether it can escape the gravitational pull of a potential stock market collapse.

Increasing Stock Market Crash Warnings

Robert Kiyosaki, recently featured in US Crypto News, warns that stock market collapse indicators are signaling a massive downturn. In his view, this could be good news for gold, silver, and Bitcoin owners, but could deal a severe blow to Baby Boomers heavily exposed to 401(k) plans.

Some of these indicators are found in the bond market. Market commentator Financelot emphasizes the historical correlation between US 3-month Treasury yield spikes and major market collapses.

Today's yield patterns reflect peaks before collapses in March 2002, September 2008, and February 2020, raising fears that history might repeat itself.

However, not everyone believes Bitcoin will rise when traditional markets shake. Commentator Beka challenges Kiyosaki's optimism, arguing that Bitcoin has been absorbed into the traditional financial (TradFi) system and is unlikely to decouple during a stock market crash.

Gold, often considered a safe asset, has also faced headwinds. It recorded its largest drop in three months due to reports that the US will clarify its tariff policy on gold.

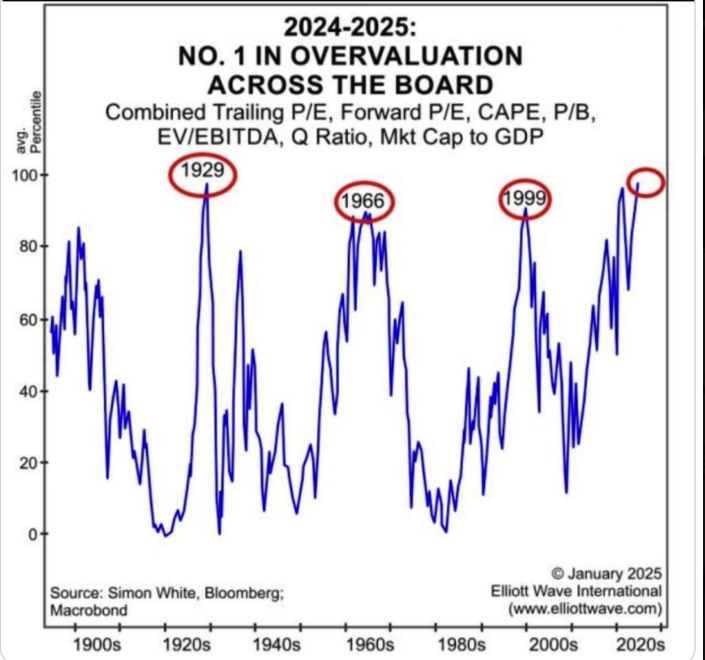

Adding another risk factor, US stocks are now valued at their most expensive levels since the Great Depression.

Nevertheless, cryptocurrency traders are focusing on short-term catalysts. Bitcoin has recovered to $122,000. Analyst Ted Pillows notes that while altcoins dominated last week, the softer CPI figures to be released tomorrow could trigger a new all-time high for Bitcoin.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating to English.]- An Ethereum developer has reportedly been detained in Turkey.

- As Bitcoin recovers to $122,000, here are four US economic indicators to watch this week.

- Lido price surged 58% in 5 days as LDO active addresses hit a two-year high.

- BNB's price is at $1,200 after surpassing Nike in market capitalization.

- Bitcoin's next all-time high may be near. Two indicators suggest further increase.

- Two factors suggest Solana could soon break through $190.

- Ripple's $3.28 billion escrow unlock is hindering XRP price breakthrough.

- Three altcoins at major liquidation risk in the second week of August.

Cryptocurrency Stock Market

| Company | Closed on August 8 | Pre-market Overview |

| Strategy (MSTR) | $395.13 | $406.00 (+2.75%) |

| Coinbase Global (COIN) | $310.54 | $320.50 (+3.31%) |

| Galaxy Digital Holdings (GLXY) | $27.78 | $28.90 (+4.03%) |

| Marathon Holdings (MARA) | $15.38 | $15.86 (+3.12%) |

| Riot Platforms (RIOT) | $11.08 | $11.46 (+3.43%) |

| Core Scientific (CORZ) | $14.41 | $14.23 (-1.25%) |