The cryptocurrency market has been showing strength recently, and Doge is no exception. This meme coin rose by more than 16% last week, but has been trading sideways over the past day.

Some on-chain and chart signals suggest that sellers are preparing to realize profits. This could lead to a short-term pause or correction. Whether DOGE continues to rise or falls depends on key support levels.

Increasing Profit-Taking Pressure

The percentage of addresses in profit for DOGE recently reached about 84%, which is the same level before the price dropped from $0.24 to $0.19 on July 27th. Historically, when many holders are in profit, some tend to cash out.

Supporting evidence is the spot net inflow, which switched from -$52 million on August 10th to +$2.7 million on August 11th. More DOGE is moving to exchanges, indicating traders are preparing to sell.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

SOPR, Correction from Profit-Taking?

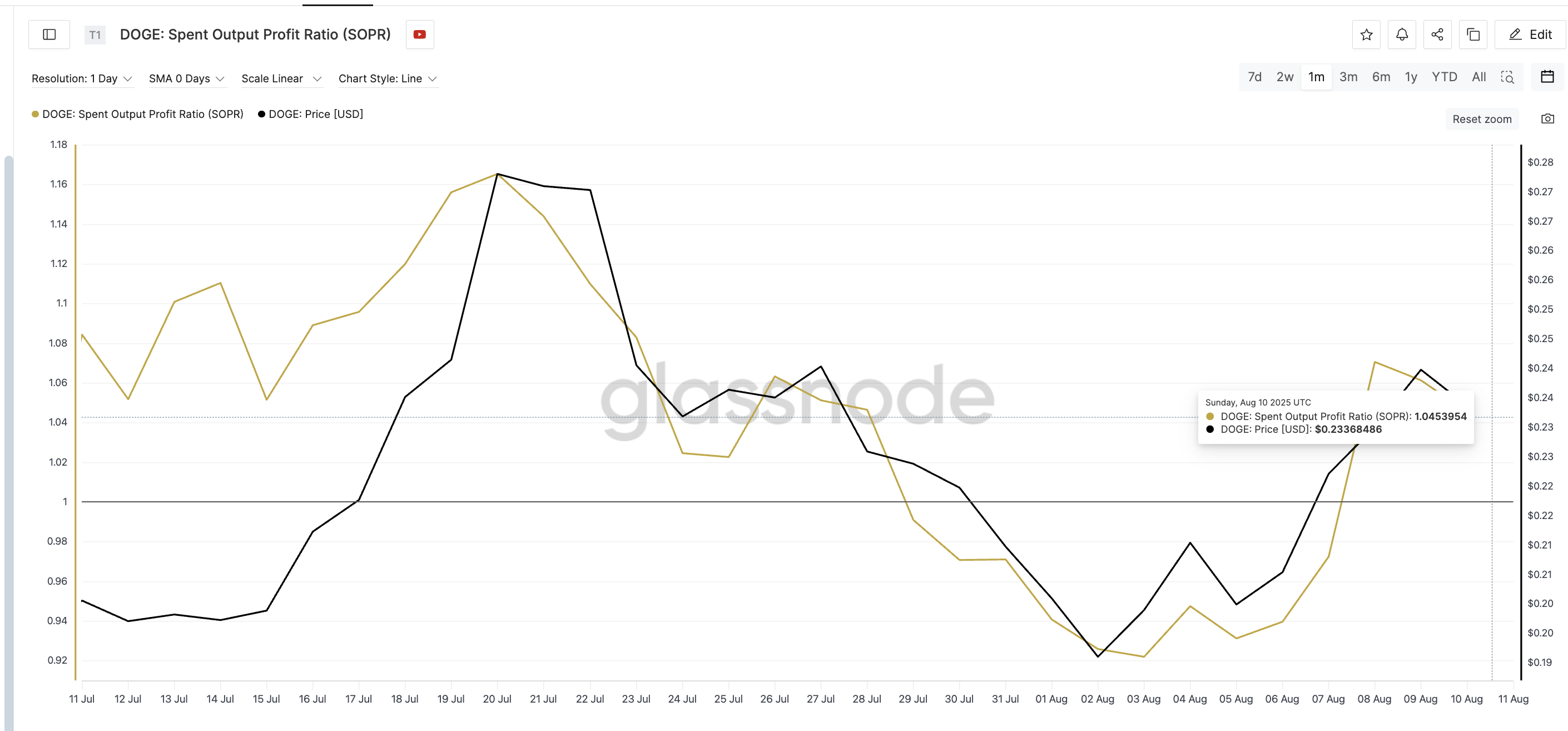

The Spent Output Profit Ratio (SOPR) shows whether coins are being sold at a profit or loss. A value above 1.0 means holders are realizing profits.

On August 10th, DOGE's SOPR rose to 1.045, similar to levels observed in late July. This was followed by a quick correction. This suggests the market may be approaching another short-term correction point. The rising SOPR also aligns with the selling-based narrative.

Key Levels on Chart to Determine Doge Price Direction?

On the 4-hour chart, DOGE price is hovering near $0.235, just below the downtrend line of a descending triangle pattern. This setup indicates short-term weakness and suggests entering a correction.

Fibonacci levels serve as the base of the descending triangle, appearing as key support levels. The Doge price has broken through several levels coinciding with $0.23. If $0.235 breaks, traders should carefully watch the next hints:

- Support level to watch: $0.22 — this level was previously strongly maintained. If maintained again, buyers might intervene.

- If it breaks, the Doge price could go lower.

- Bullish trigger: Breaking $0.24~$0.246 would break the triangle and provide an opportunity to challenge the bullish market again.

Breaking $0.24 could invalidate the bearish triangle and maintain bullish momentum. Currently, $0.22 is the critical line that could determine whether DOGE continues to rise or sees further decline.