As Bitcoin (BTC) and Ethereum (ETH) are on the verge of breaking their all-time highs, attention is also focused on the possibility of major altcoins breaking their previous peaks. Binance Coin (BNB) and XRP are emerging as the next candidates, stimulating investment sentiment.

According to CoinMarketCap, a global cryptocurrency market tracking site, at 4 PM on the 12th, BTC was trading at $118,875, with only a 3.39% gap from its previous all-time high (July 14th). ETH is at $4,292, which is 12.16% lower than its previous peak (November 16th, 2021), but analysis suggests a high likelihood of breaking through if the recent upward trend continues.

Related Articles

- "Higher than Bitcoin this year?"... Buying 'this coin' and stock price surges 15%

- New York stock market's three major indices decline... Bitcoin at $118,800 [Decenter Market Conditions]

- Positive news of 'Harvard Investment'... Bitcoin domestic highest price

- Bitcoin recovers to $119,000... Ethereum taking a breather at $4,200 [Decenter Market Conditions]

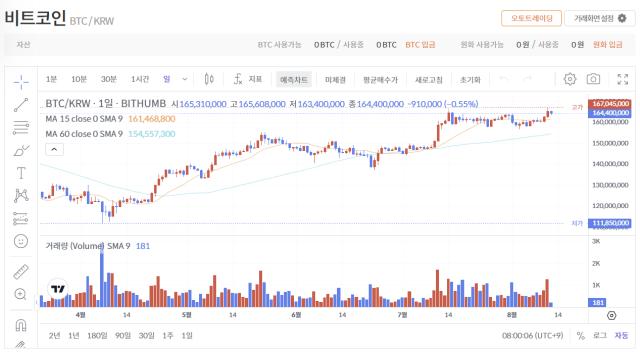

Domestic exchanges have already been breaking previous peaks. BTC traded at 167 million won on Bithumb at 2:10 PM the previous day, recording a domestic all-time high. ETH had already set a new high at 6,963,000 won at 9 AM on the 10th.

Following BTC and ETH, Binance Coin (BNB) and XRP are gathering expectations for breaking previous peaks. These two cryptocurrencies have the smallest gap from their previous all-time highs at -6.05% and -18.14% among the top 10 market cap coins. Particularly, BNB has been maintaining a solid upward trend thanks to recent listing companies' accumulation strategies.

XRP has not exceeded its previous peak for over 7 years since January 2018, drawing attention to whether it can break out of its long-term slump. With the lawsuit with the U.S. Securities and Exchange Commission (SEC) finally concluding after 5 years and regulatory risks resolved, a rebound is anticipated.

In contrast, Cardano (ADA), Dogecoin (Doge), and Chainlink (LINK) remain at prices more than 50% lower than their previous peaks at -74.82%, -69.68%, and -59.41% respectively. The prevailing assessment is that their recovery possibility is low, having failed to set new highs for 4 years since their 2021 peak.

Experts are mentioning the possibility of an 'altcoin season', adding momentum to the expectations of breaking previous peaks. Analysis suggests that after BTC and ETH break through major resistance lines, funds are increasingly flowing into altcoins. In fact, BTC's market share has dropped to the 50% range for the first time in 5 months according to CoinMarketCap. Zhuang Wedson, founder of cryptocurrency data analysis platform AlphaFractal, predicted, "The altcoin party has just begun and could continue until November".

However, the U.S. Consumer Price Index (CPI) announcement scheduled for this day is expected to be a variable. As the July CPI announcement approached on the 12th (local time), the cryptocurrency market turned cautious and could not maintain the previous day's upward trend. This CPI announcement is expected to significantly influence the Federal Reserve's decision on whether to lower the benchmark interest rate in September.

CoinDesk analyzed, "BTC failed twice to break the resistance line formed in the $122,000 range, showing that buying sentiment has been exhausted ahead of the U.S. CPI announcement" and "If the CPI exceeds expectations, there is a possibility of a selling trend".

- Reporter Kim Jung-woo

< Copyright ⓒ Decenter, reproduction and redistribution prohibited >