The cryptocurrency market in 2025 is showing positive signals, with the total market capitalization once again exceeding 4 trillion dollars. The market is setting the stage for the largest bull market in history.

Let's examine the factors that could trigger an explosive rise.

Analysts Predict Unprecedented Coin Bull Market

In this context, analyst Miles Deutscher shared his perspective on the current market.

"The biggest bull market in cryptocurrency is ready to open. The industry has never experienced the speed of this momentum and change." – Miles Deutscher, analyst stated.

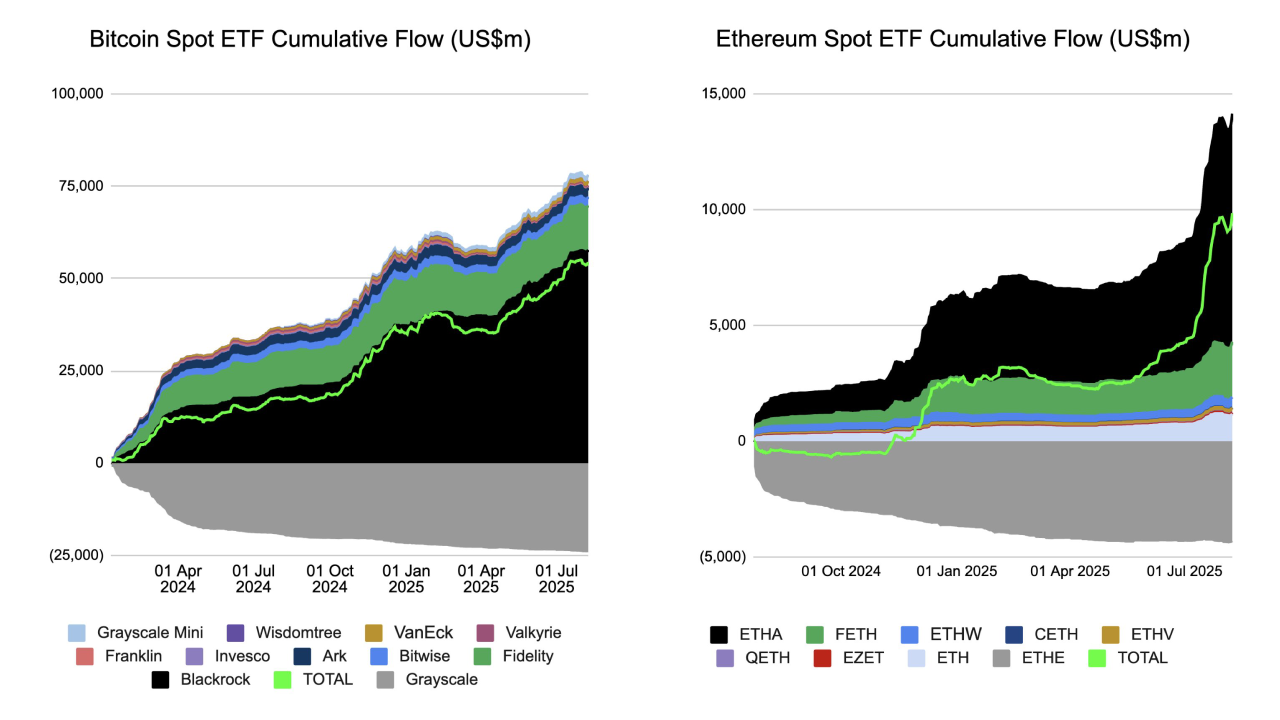

First, according to data, total inflows into US-listed cryptocurrency ETFs reached approximately 12.8 billion dollars in July. Miles emphasized that "with just physical BTC and ETH ETFs" there were about 17 billion dollars in net inflows over the past 60 days. This significantly impacted liquidity and asset valuation.

Second, the US Congress and White House have passed/implemented key bills and policies to expand alternative asset access for stablecoins (GENIUS Act) and 401(k) plans. This opens the possibility of massive capital inflow into cryptocurrencies in 2025.

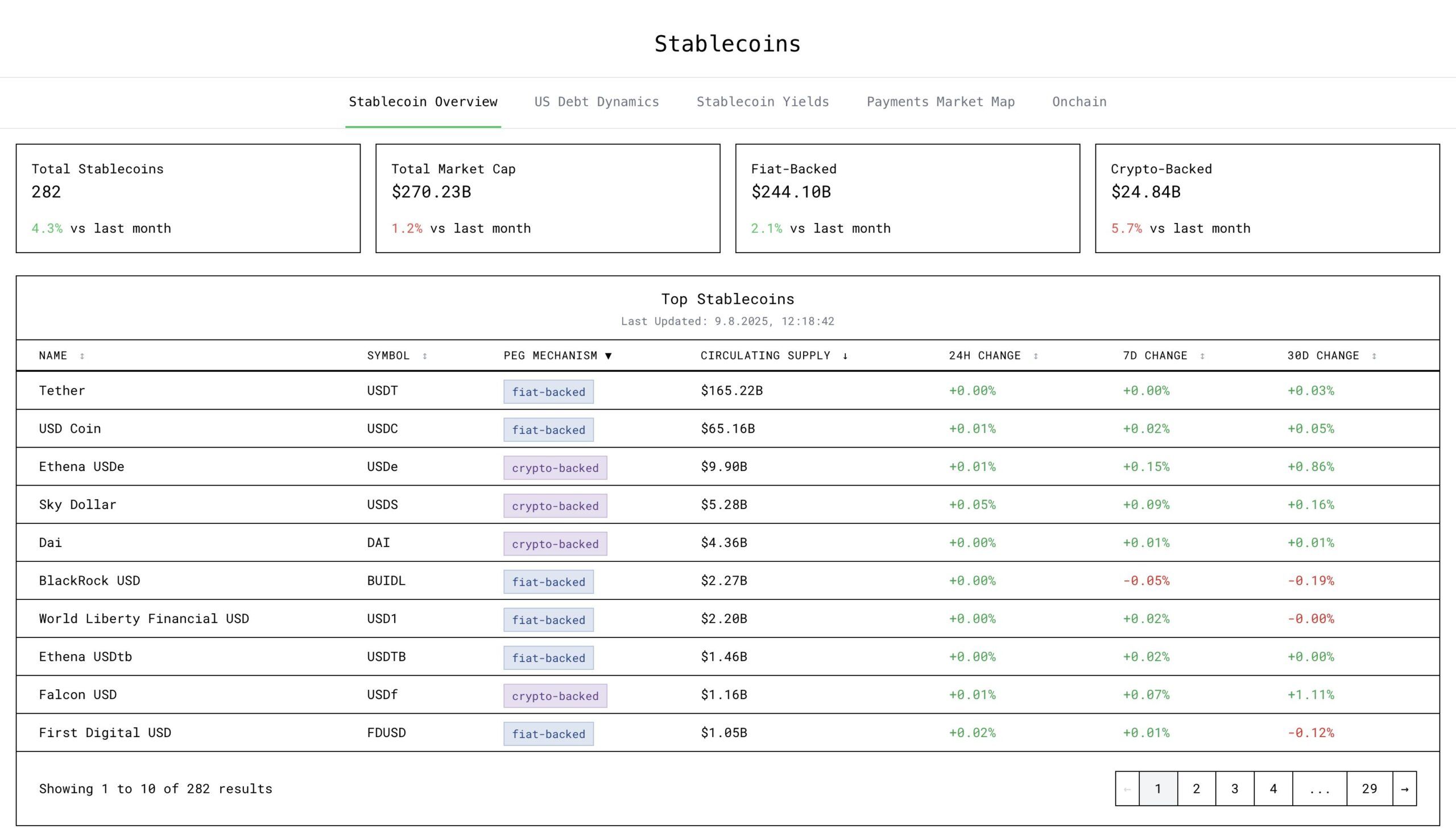

Third, data shows the total stablecoin market capitalization is around 270-282 billion dollars. This reflects an increase in on-chain money supply that enhances market liquidity for trading and promotes tokenization.

Fourth, SEC filings reveal major institutional interest in cryptocurrencies. For example, a recent report shows that Harvard University disclosed a significant position of approximately 116-117 million dollars in BlackRock's IBIT fund. This indicates that ETFs will be a primary channel for institutional capital inflow into cryptocurrencies in 2025.

Fifth, political support from President Trump and his family. As the market environment becomes more "breathable", it can reach a broader audience, especially traditional investors.

According to Miles, another factor is ETH recovering to the $4,000 level. This provides strong momentum towards its all-time high from 2021. BTC and ETH are not collapsing despite severe FUD. This suggests consistent market demand along with seller exhaustion.

Additionally, Miles noted that Bitcoin dominance looks very weak for the first time since 2024. Liquidity is becoming more concentrated in major coins/CEXs, making the BTC/ETH trend more pronounced.

"This is crucial in forming the current stage of the cycle. It creates more favorable conditions for altcoin rotation later." – Miles Deutscher, analyst observed.