Bitcoin Rise Again, Riding a Weak Dollar… Kaiko Research Analyzes Global Liquidity Flows

This article is machine translated

Show original

In 2025, amid increasing uncertainty in the U.S. financial environment, Bitcoin (BTC) is showing a meaningful upward trend. Kaiko Research recently analyzed in their report that dollar weakness, changes in Federal Reserve policy, and expanded global risk asset preference directly contributed to the Bitcoin rally.

In early August, Bitcoin rebounded from a low of $112,000 to a sharp rise near $123,000, with a clear dollar weakness as the background. Compared to the beginning of the year, Bitcoin has risen 26% in U.S. dollar terms, which is higher than the 19% rise in Korean won and 10-12% rise in Brazilian real and euro. According to Kaiko Research, this rise was primarily promoted after the U.S. tariff increase in April, the 'Liberation Day' tariff announcement, and as the dollar's strength weakened, cash flows toward alternative assets rapidly expanded.

Considering that over 90% of global cryptocurrency trading volume is conducted in dollars or dollar-pegged stablecoins, changes in dollar value are the most significant variable in market liquidity and trading volume. Particularly, after the Federal Reserve's unexpected 50bp rate cut in September 2024, the net buying volume in the Bitcoin spot market surged and rose by about 2%, confirming that U.S. monetary policy still plays a pivotal role in cryptocurrency price determination. The more distinct reaction compared to ECB policy further reinforces this trend.

Meanwhile, Bitcoin is also showing superiority in relative performance to gold. The BTC to gold ratio reached a multi-month high this summer, and Bitcoin ETF inflows in the U.S. have approached major gold ETF assets. With reduced volatility, Bitcoin is strengthening its institutional asset position by surpassing gold and stocks in terms of risk-adjusted returns, even in crisis situations. According to Kaiko Research's data, this trend is more pronounced in major fiat currency trading markets centered on the U.S.

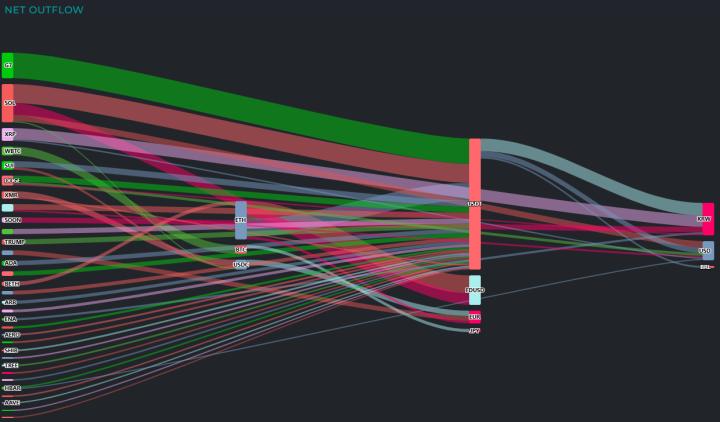

The report also pointed out the concentration of global liquidity in dollar trading pairs and the structural differentiation of regional cryptocurrency markets. Dollar-based trading volume from January to July this year reached $1.56 trillion, with Korean won at $880 billion, the second-highest figure. However, despite a 17% growth compared to the previous year, the Korean won market showed relatively poor performance with the largest dollar gap since 2020. This is due to the unique uncertain regulatory environment in the Korean market and institutional barriers such as the 'one-bank rule'.

The stablecoin market continues to show structural growth. The 2% market depth of major stablecoin USDC is approximately $544 million, recently nearly doubling. The 2% depth is an indicator for assessing market liquidity regardless of interest rates and is very significant in thin order book trading pairs. Stablecoin transactions have a competitive advantage in speed and efficiency compared to traditional fiat currencies, especially securing a 'liquidity premium' in emerging markets with high exchange rate volatility.

XRP-related data is also notable. The 1% market depth of XRP on U.S. cryptocurrency exchanges reached $116 million last week, setting a new all-time high. This is a result of market makers in the U.S. reorganizing XRP exposure as the SEC lawsuit filed in 2020 officially concludes in August 2025. Although price rebound was limited, the resolution of the trading structure centered on overseas exchanges is expected to increase the possibility of XRP spot ETF approval.

The increase in stablecoin and XRP liquidity and Bitcoin's strengthened position as an alternative asset are trends emerging within the dollar-centered global asset strategy change. Kaiko Research reported that it is necessary to pay attention to how institutional flows will readjust the cryptocurrency market by analyzing these changes in depth.

Sector:

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content