The trading patterns of top cryptocurrency futures traders are used as an important indicator to gauge the future movements of the cryptocurrency market. As they possess high trading expertise and market sensitivity, examining which assets they concentrate their long positions on helps understand the overall investment sentiment and direction. However, some may use futures contracts to hedge spot positions, requiring additional analysis when interpreting data. Coinglass defines top traders as investors in the top 20% of margin balance. [Editor's Note]

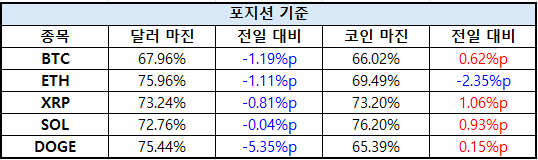

Major Asset Long Position Status

According to Coinglass as of 9:05 AM on the 13th, Bitcoin's dollar margin was 67.96%, down 1.19%p from the previous day, while its coin margin was 66.02%, up 0.62%p, showing a mixed trend between margins.

Ethereum's dollar margin was 75.96%, down 1.11%p, and its coin margin was 69.49%, down 2.35%p, indicating an overall weakening of buying sentiment.

XRP's dollar margin was 73.24%, down 0.81%p, but its coin margin was 73.20%, up 1.06%p, showing a contrasting trend.

Solana's dollar margin was 72.76%, down 0.04%p, while its coin margin was 76.20%, up 0.93%p, showing strength in the coin margin.

Dogecoin's dollar margin was 75.44%, down 5.35%p, but its coin margin was 65.39%, up 0.15%p, displaying differences between margins.

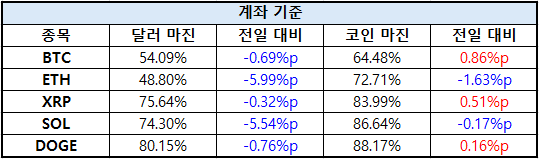

Long Position Account Proportion

Based on top trader accounts, Bitcoin's long proportion was 54.09% on the dollar margin, down 0.69%p from the previous day, while its coin margin was 64.48%, up 0.86%p, showing contrasting trends between margins.

Ethereum's dollar margin was 48.80%, down 5.99%p, and its coin margin was 72.71%, down 1.63%p, showing weakness in both margins.

XRP's dollar margin was 75.64%, down 0.32%p, but its coin margin was 83.99%, up 0.51%p, recording a mixed trend.

Solana's dollar margin was 74.30%, down 5.54%p, and its coin margin was 86.64%, down 0.17%p, indicating an overall weakening of buying sentiment.

Dogecoin's dollar margin was 80.15%, down 0.76%p, but its coin margin was 88.17%, up 0.16%p, maintaining the highest long position account proportion among major assets.

Strongest Position Assets

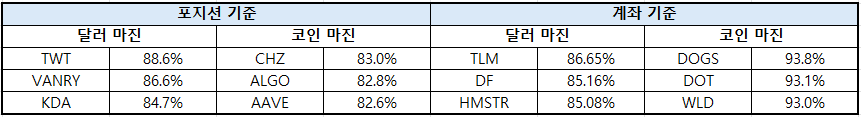

Based on top traders, in terms of position proportion, the dollar margin market showed high long proportions for ▲TWT(88.6%) ▲VANRY(86.6%) ▲KDA(84.7%). In the coin margin market, ▲CHZ(83.0%) ▲ALGO(82.8%) ▲AAVE(82.6%) were in the top ranks.

In terms of account-based strong assets, the dollar margin market showed high long position proportions for ▲TLM(86.65%) ▲DF(85.16%) ▲HMSTR(85.08%). In the coin margin market, ▲DOGS(93.8%) ▲DOT(93.1%) ▲WLD(93.0%) recorded over 90% proportion, showing a clear buying advantage.

The dollar margin market (U market) is mainly preferred by institutional investors seeking stable returns, used to reduce volatility and for short-term trading and hedging. The coin margin market (C market) is often used by cryptocurrency bulls or long-term holders to increase assets through leverage. In a bullish market, the unsettled contracts in the C market increase, indicating market optimism, while in a bearish market, increased trading volume in the U market may suggest institutional fund inflow.

[This article does not provide financial advice, and the investment results are the sole responsibility of the investor.]

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>