Bitcoin's price has reached a new all-time high for the first time in a month, leading an optimistic trend in the virtual asset market. This is primarily attributed to the U.S. inflation figures meeting market predictions, which has increased expectations of a potential interest rate cut.

On the afternoon of August 13th Eastern Time, Bitcoin, the representative cryptocurrency, was traded at $123,677 per coin. This is higher than the previous all-time high recorded on July 14th, representing a 2.96% increase from the previous day. The price continues to rise during trading hours, forming new peaks.

Bitcoin's sharp rise was triggered by the spreading expectation that the Federal Reserve (Fed) might reduce interest rates next month. The recently announced U.S. Consumer Price Index (CPI) aligned with market expectations, interpreted as a signal that inflation is no longer strong. Consequently, funds are flowing back into risky assets like cryptocurrencies.

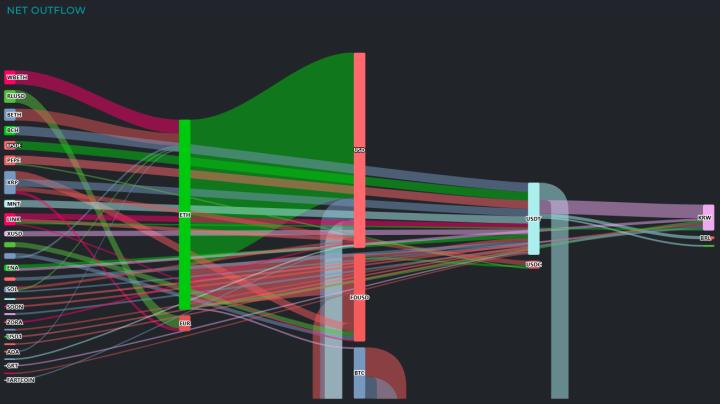

The cryptocurrency market overall is also showing strength following Bitcoin's trend. Ethereum, the second-largest market cap cryptocurrency, recorded $4,785, its highest level since November 2021, approaching its previous peak of $4,800. Additionally, Solana surpassed $200, while Dogecoin and Ripple (XRP) also showed upward momentum.

Market experts believe this price increase may not be limited to short-term expectations. LMAX Group, which operates foreign exchange and crypto asset platforms, assessed that the simultaneous rise in stock markets and cryptocurrency markets is supporting Bitcoin's strength across the broader capital market. 10X Research, a cryptocurrency analysis firm, noted the increasing risk appetite in financial markets, including narrowing credit spreads and rising loan growth rates.

The current market anticipates over 90% probability of a 0.25 percentage point rate cut at the upcoming Federal Open Market Committee (FOMC) meeting in September. However, some investors are increasingly demanding more aggressive monetary easing measures. Consequently, high-risk assets like Bitcoin cannot rule out the possibility of even larger rebounds.

This trend could be further reinforced depending on economic indicators and additional signals from the Federal Reserve, with potential for closer correlation between stock markets and virtual assets. Particularly if interest rates are actually reduced, investor funds are expected to quickly move back to risky assets like cryptocurrencies.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>