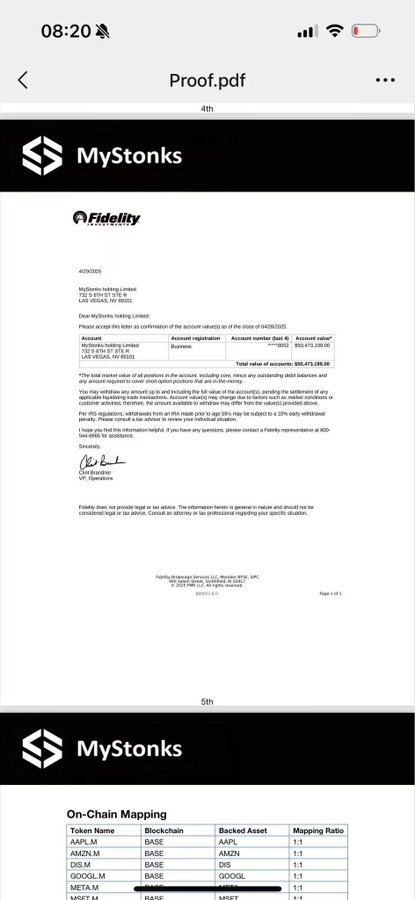

A fellow member provided this so-called "Fidelity Custody Proof". I won't comment on its authenticity, but English speakers should recognize this as a Fidelity account balance confirmation. The header is Fidelity Investments, dated 2025-04-29. Addressed to "MyStonks holding Limited", listing account registration type as Business, last four account digits ...8002, total account value $50,473,199.00. Signed by "Clint Brandner, VP, Operations". The footer reads "Fidelity Brokerage Services LLC, Member NYSE, SIPC … ©2025 FMR LLC". This type of letter is a balance/position value confirmation requested by customers from brokers, used for reconciliation or external explanation of "the entity's assets at Fidelity at a certain point in time". It is neither a collaboration announcement nor a custody agreement or regulatory approval. Lower half: MyStonks' self-made "On-Chain Mapping" table Listing tokens like AAPL.M, AMZN.M, GOOGL.M, META.M on the Base chain, with "Mapping Ratio 1:1". This is the project's self-described mapping list, not equivalent to third-party audit or custodian endorsement. Similarly, I won't argue about the authenticity of this confirmation letter, assuming it's genuine: Can Prove: Confirms that an account of MyStonks holding Limited had approximately $50.47 million in account value at Fidelity on 2025-04-29 (possibly including cash, broker settlement funds, or total market value of securities/options). Only valid at that time; four months have passed, current account balance and existence are unknown. Cannot Prove: No evidence of an "official cooperation/custody agreement" with Fidelity, lacking Fidelity's own press release or contract number. No proof that assets are legally "isolated in a special account, held in trust for token holders" (absent beneficiary structure/trust/third-party control agreement/account purpose limitation). Cannot verify "1:1 mapping" authenticity and continuity (lacking daily reconciliation/third-party audit/verifiable minting-burning and broker clearing). No direct relation to "qualified for public sale/matching of tokenized securities" (not equivalent to Broker-Dealer/ATS/exchange qualifications or market licenses in target jurisdictions). Suspicious Points!! MSB registration shows MyStonks Holding Limited (BVI, Road Town), but this letter uses "MyStonks holding Limited, address Las Vegas NV", with inconsistent capitalization (legal entities typically have precise capitalization and punctuation). Are these the same company? Why use a BVI company with a US address? Provide company registration certificate + director resolution/account opening documents to verify entity consistency. Fidelity's balance confirmations are typically generated in customer backend; should include verifiable reference number/verification hotline; recent monthly statements should contain CUSIP/stock codes/quantities, not just total value. Can you provide periodic proof of on-chain circulation to broker/custodian physical positions (preferably verified by third-party accounting firm); minting/burning rules and redemption process; how can tokens be exchanged back to underlying stocks? What are the thresholds/fees/time limits? I'll repeat: professionalism is crucial.

This article is machine translated

Show original

Phyrex

@Phyrex_Ni

To be honest, I really don’t want to talk about this topic anymore. The market is doing so well right now—buying some $BTC or $ETH would be much better. I understand your perspective, but honestly, the less I say, the better it is for you. Some of your buddies even brought up how #Binancexrism#OKX77/…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content