SKALE (SKL) rose by over 100% last week and recorded a 44% increase over the past 24 hours. The token is currently trading near $0.039 after testing slightly higher levels.

This explosive movement caught the attention of momentum traders, but several on-chain and technical indicators suggest the rally could quickly enter a correction or consolidate.

Dormant Coins Awakening... A Correction Harbinger?

We examine the Spent Coins Age Band, which indicates when long-idle coins begin moving. This typically results from profit-taking after a sharp rally. During the last session, this indicator increased from 33.36 million SKL to 173.62 million SKL (approximately 5.2 times, or about 420%).

In July, small local peaks around July 15th, 24th, and 29th were followed by subsequent sessions of SKALE price decline. When large blocks of dormant coins suddenly move, supply returns to the market, which historically creates headwinds for rally continuation.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

Whales Reducing Positions While Exchange Supply Increases

We combine cohort behavior with exchange balances to verify the likelihood of "moved coins" meeting immediate liquidity.

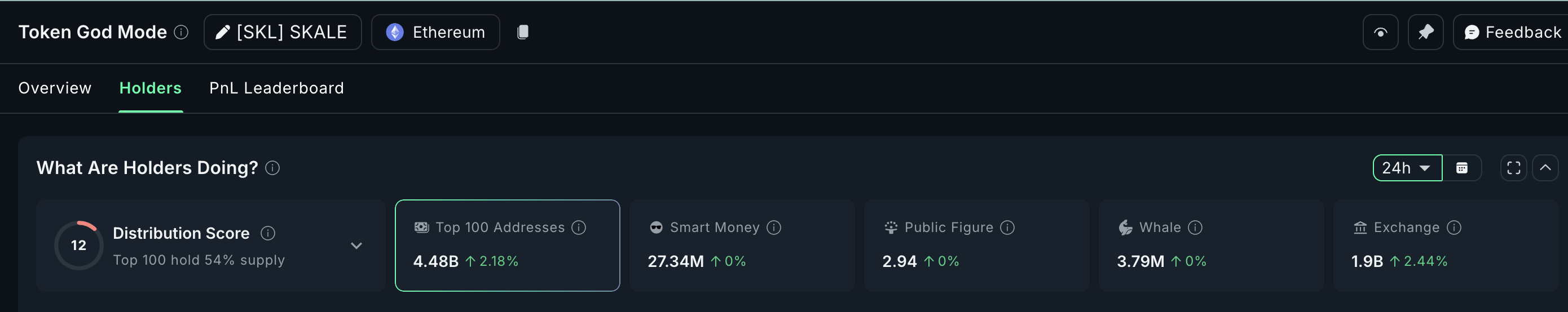

The 10 million - 100 million SKL cohort (major swing whales) reduced holdings from 3.27 billion SKL to 3.14 billion SKL. This represents a decrease of 130 million SKL (4%). Simultaneously, exchange reserves increased by 2.44% to 1.9 billion SKL, meaning 45.3 million SKL flowed into exchanges within 24 hours.

Overall, whales reducing positions and more coins being on exchanges creates a selling readiness. Even if some whale movements are internal rebalancing, the pure picture indicates more immediately available supply than yesterday.

As the chart mentioned, this cohort previously dumped SKL supply, which coincided with price declines.

SKL Price Structure, Descending Wedge Near $0.042

Price context is most important when signals shift. On the daily chart, SKL price is pressing against the top of a rising expanding wedge. This pattern often resolves with a pause or pullback. Unless the price closes and maintains above the top rail ($0.042).

If buyers cannot force a breakout, notable levels nearby are $0.036, then $0.033 and $0.030 (current bridge's Fibonacci indicators). A deeper correction could explore $0.027–$0.023. If SKL price sets new highs, Fibonacci indicators will change. The current setup only considers the previous swing low ($0.018) and the latest swing high ($0.042).

Why rely on the pattern now? Because the wedge top overlaps with a surge in dormant coin activity and new exchange supply. Three distinct lenses point to short-term fatigue.

A strong daily SKL price close above $0.042 with follow-through could invalidate the immediate downtrend setup and open higher movement. On-chain pressure will ease if dormant coin surge settles, whales reaccumulate, and exchange balances retreat.