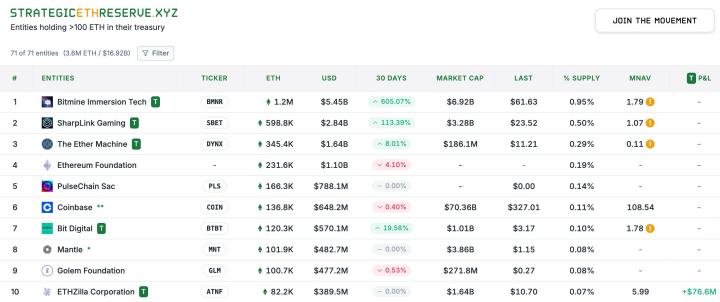

Total value locked (TVL) of decentralized finance (DeFi) on Arbitrum has reached a yearly high of $3.39 billion.

This growth comes from increased activity on the Ethereum network – fueled by increased transaction activity – spilling over to Second-Layer Solutions like Arbitrum.

Arbitrum Sees Liquidation as Ethereum Network Grows

According to defillama, Arbitrum ’s TVL has reached a yearly high of $3.39 billion, rising steadily over the past four weeks.

For Token and Market Updates: Want more Token news like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Arbitrum TVL. Source: defillama

Arbitrum TVL. Source: defillamaIncreasing TVL shows liquidation and usage across a larger network. This suggests that more Capital is being locked into smart contracts for trading, lending, or other decentralized financial activities.

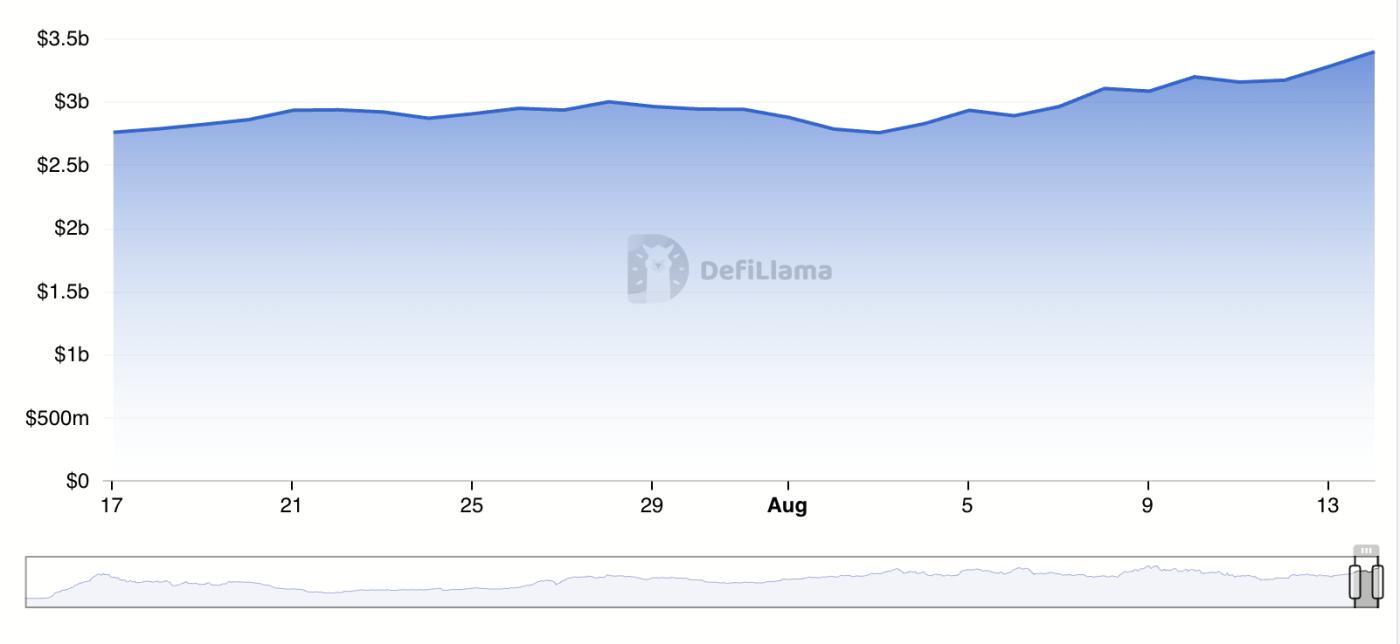

For Arbitrum, the increased user demand reflects recent activity on the Ethereum network . According to Artemis, the number of daily active Ethereum addresses has increased by 33% in the past few weeks, with volume up 10%.

Ethereum network activity. Source: Artemis

Ethereum network activity. Source: ArtemisWhen Ethereum experiences a surge in user demand like this, more activity will migrate to L2s. These networks offer faster transaction times and lower fees, attracting users who want to avoid congestion on the Ethereum main chain .

As a result, L2s like Arbitrum often see increased liquidation and participation whenever Ethereum sees increased activity.

ARB Soars as Market Interest Heats Up

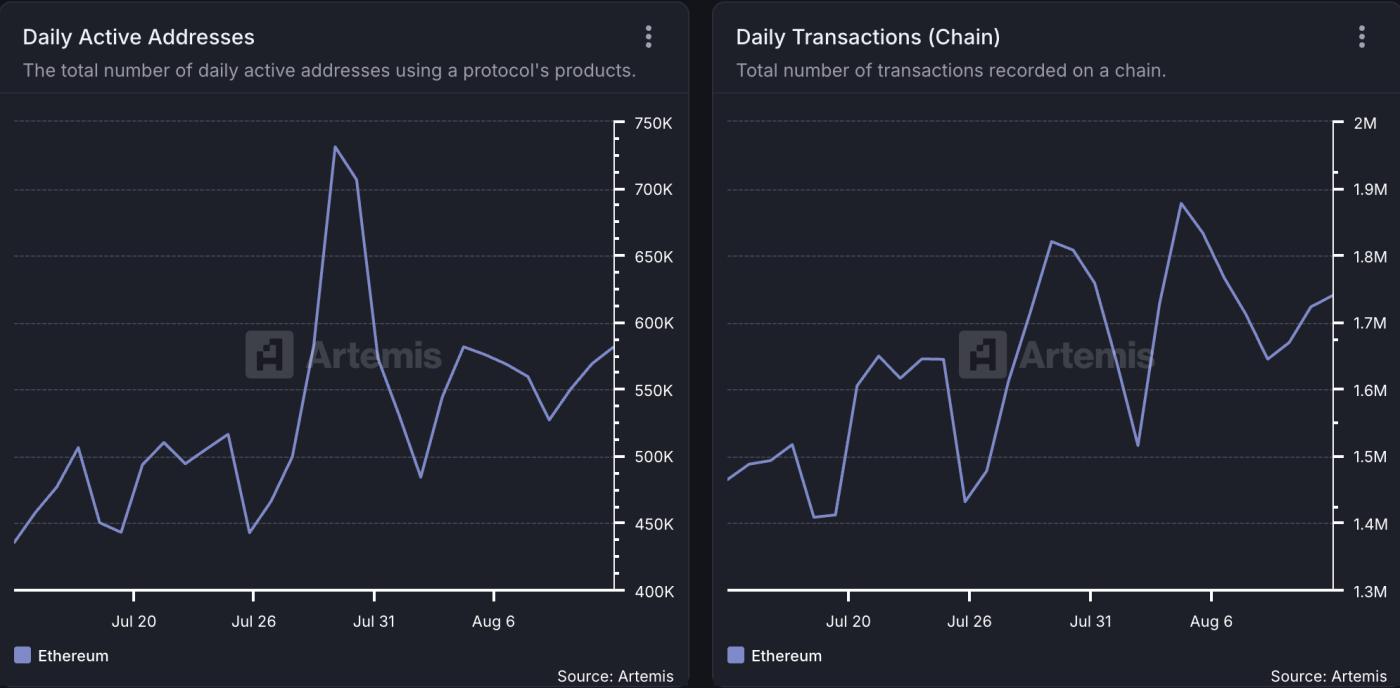

At Followin_M9xLa2 at the time of writing, ARB is trading at $0.54, up 12% over the past 24 hours. During that time, its volume has increased by 155% and now totals $1.48 billion.

ARB price and volume . Source: Santiment

ARB price and volume . Source: SantimentWhen an asset's price and volume increase simultaneously, it indicates strong market interest and bullish sentiment.

The rising price of ARB shows that demand exceeds supply, while its high volume confirms that the move is supported by significant participation rather than thin liquidation . This trend usually attracts more traders and investors, and could drive further gains for ARB in the short term.

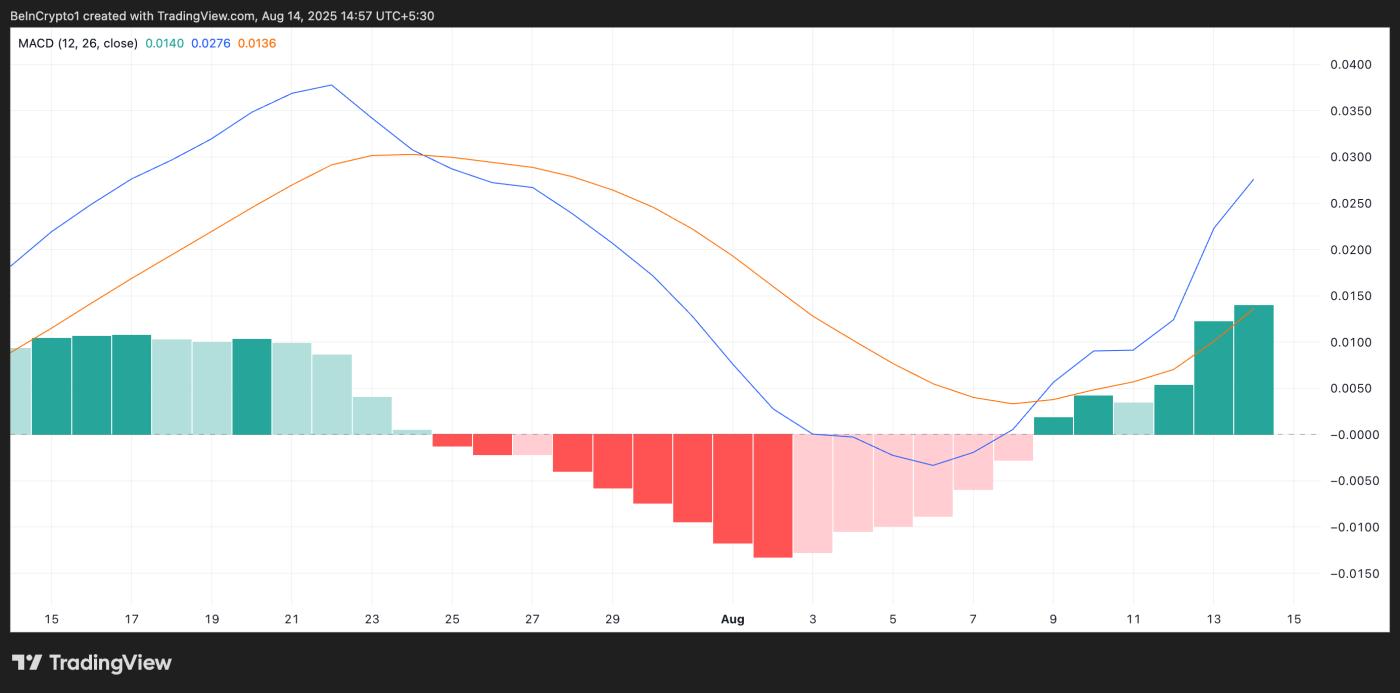

Furthermore, the bullish crossover of ARB ’s Moving Average Convergence Divergence (MACD) setup supports this bullish outlook. At the time of writing, the Token ’s MACD line (blue) is above its signal line (orange), confirming buying pressure.

ARB MACD. Source: TradingView

ARB MACD. Source: TradingViewFurthermore, the histogram bars that make up the MACD indicator have been gradually growing since August 6, 2025, with the green bars expanding in size. When this happens, it shows that the uptrend is strengthening.

Can the bulls push ARB to $0.74?

Continued accumulation of ARB could push its price towards $0.62. If this resistance level is successfully broken, ARB price could move towards $0.74, the high it last reached in January.

ARB Price Analysis. Source: TradingView

ARB Price Analysis. Source: TradingViewHowever, if a sell-off begins, the altcoin price risks falling to $0.45.