SHIB's price has remained relatively quiet for most of this week, hovering while the cryptocurrency market shows an upward trend.

This upward trend has spread to the meme coin ecosystem, with several small and medium-sized meme tokens recording significant gains this week. Surprisingly, despite the overall market's enthusiasm, SHIB has struggled to leverage this momentum. The reasons are as follows.

Shiba Inu, Decrease in Major Investor Holdings

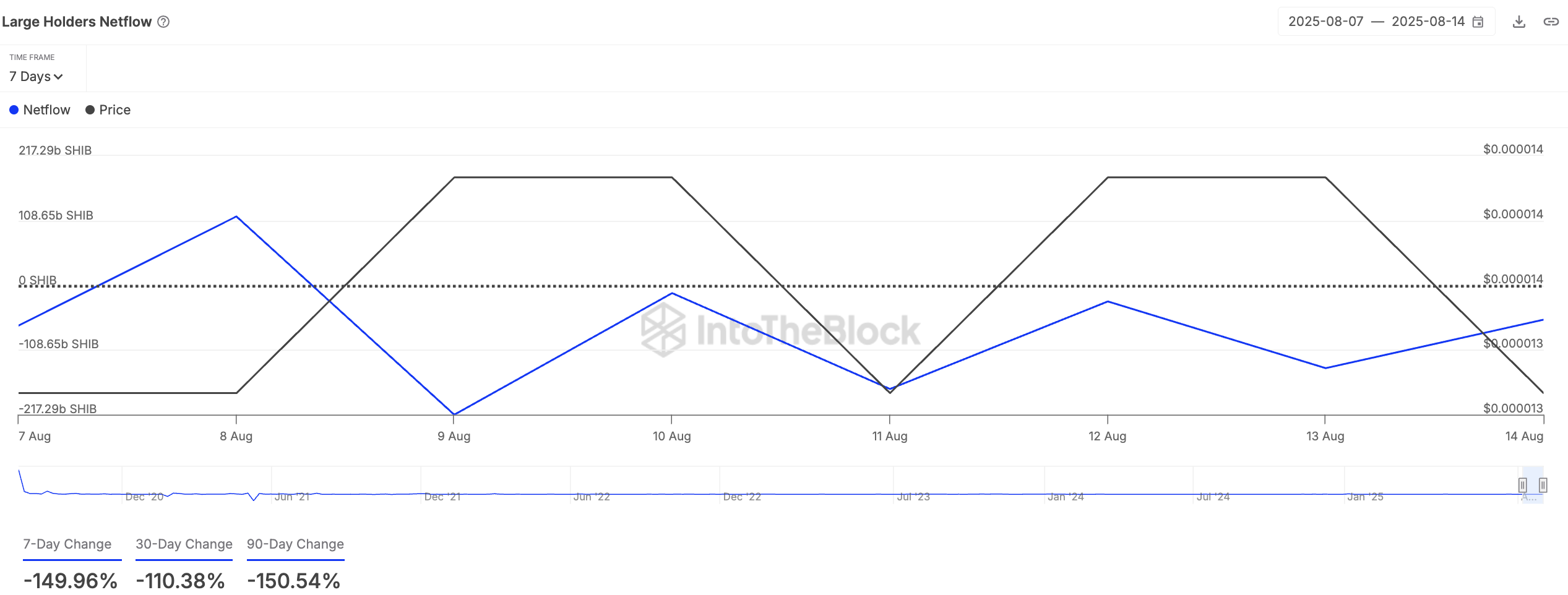

According to the on-chain data platform IntoTheBlock, SHIB experienced a 150% decrease in large holder net inflows last week. This suggests a retreat by major investors.

Token Technical Analysis and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

Large holders are whale addresses holding more than 1% of the asset's circulating supply. Their net inflow tracks the difference between coins they have bought and sold during a specific period.

An increase in an asset's large holder net inflow indicates more coins are flowing into whale wallets, suggesting they are accumulating assets and showing confidence in future value.

Conversely, a decrease in net inflow indicates whales are selling more of the asset, resulting in net outflows from their wallets. This suggests a decrease in confidence in SHIB's short-term performance and puts downward pressure on the asset's price.

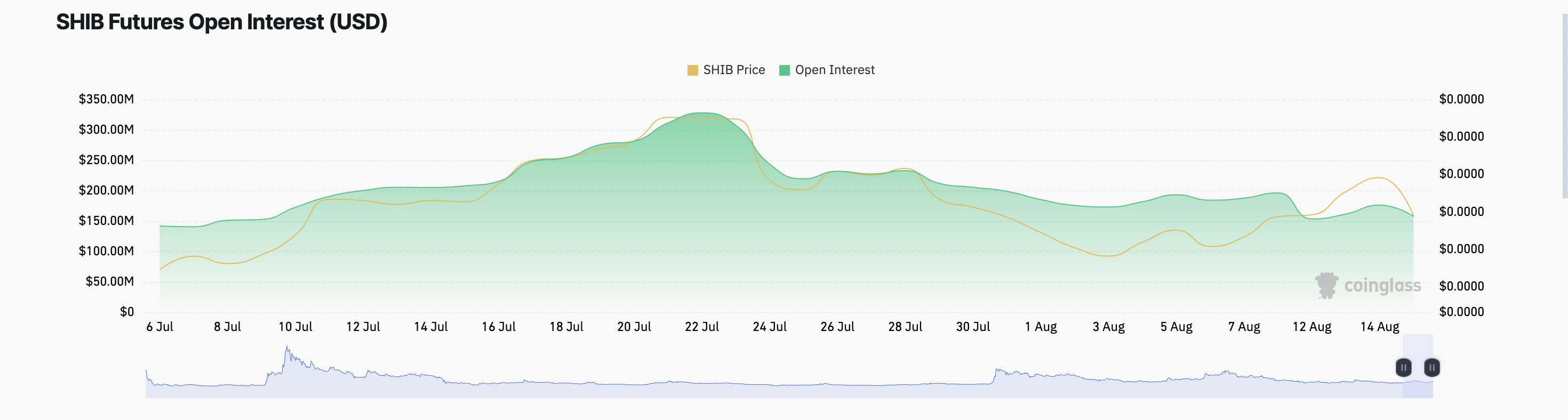

Moreover, poor price performance has led to deactivation among SHIB futures traders, with open interest dropping to a 30-day low. According to Coinglass, SHIB's futures open interest is $158 million, a 15% decrease over the past 7 days.

Open interest measures the total number of outstanding futures or options contracts for an asset that have not yet been settled. A decrease in open interest indicates that traders are not opening new positions and are closing existing ones, suggesting reduced market participation.

The decline in open interest during SHIB's poor price performance indicates diminishing market interest and weakening confidence in the meme coin's short-term trajectory.

Buyers Intervene Before $0.00001295 Decline?

The readings on the SHIB/USD daily chart show the meme coin is currently positioned below the Super Trend indicator, forming a dynamic support at $0.00001446.

This indicator tracks the direction and strength of an asset's price trend. It is displayed as a line on the price chart, with colors changing to indicate the trend: green for an upward trend, red for a downward trend.

When an asset's price trades below the Super Trend indicator, selling pressure dominates the market. If this situation continues, SHIB could fall below a narrow pattern to drop below $0.00001295.

On the other hand, if new demand reappears, it could trigger a rebound to $0.00001385.