XRP price has stalled, and this stagnation is suspicious. Over the past 7 days, the price has dropped 4.7%, but it has risen almost 400% year-on-year. Despite this significant annual increase, XRP is trading in a narrow range just below $3. Why didn't the rally continue?

On-chain data can provide the answer. Whale inflows to exchanges are colliding with retail purchases. As in January, the side exerting more pressure can determine whether XRP will break through or decline.

Whales Return to Exchanges

One of the clearest signals of whale behavior is how many XRP are being sent to exchanges. On August 7, Cryptoquant reported that the 30-day simple moving average (SMA) of whale-to-exchange inflows surged to 9,298. This is the second-highest surge this year, following the peak on January 18, after which XRP declined from $3.27 to $1.70 over four months.

The pattern is familiar: whale inflows surge, and the price stalls or reverses. XRP is failing to break through the psychological barrier of $3. Historically, such inflow pressure often limits price rallies, especially when smaller buyers cannot follow.

Whale-to-exchange inflows measure the number of tokens large holders (whales) send to centralized exchanges. A rise in this metric usually indicates potential selling pressure. We use a 30-day SMA to reduce daily noise and identify clear trends.

Token TA and Market Update: Want more such token insights? Subscribe to the daily crypto newsletter by editor Harsh Notariya here.

Individual Investors Continue Buying

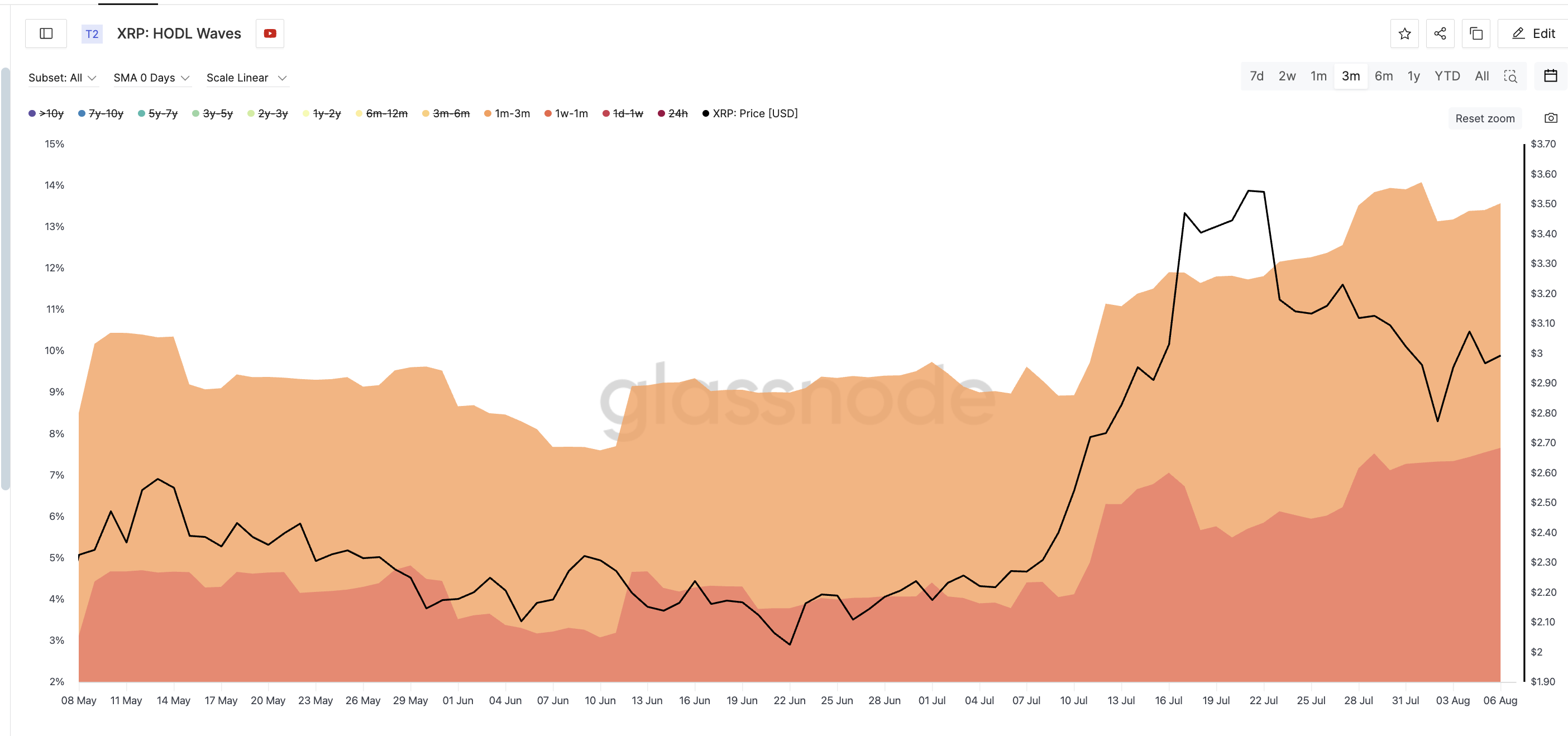

Not everyone is showing weakness. While whales are sending XRP to exchanges, short-term holders have steadily increased their positions over the past month. These wallets typically hold for 1 week to 3 months and have consistently bought during declines.

On July 10, when XRP was trading at $2.54:

- 1 week–1 month holders held 4.117% of the supply

- 1 month–3 months holders held 4.81%

By August 6, these numbers increased to:

- 1 week–1 month: 7.657%

- 1 month–3 months: 5.912%

This is a significant accumulation increase, especially reflecting behavior similar to before XRP's rally in July. If retail purchases continue at this rate, it could eventually lead to a breakout if the price forms a bottom and whales stop selling.

HODL waves show how long coins have been held in wallets, allowing us to determine whether short-term or long-term holders are driving market action. Here, we focused on the 1 week–1 month and 1 month–3 months bands to track recent accumulation.

XRP Price in a Box, Change Coming Soon?

The price is testing support at $2.94, with several daily closes remaining above it. This is a key short-term zone to watch. If XRP maintains this level and buying pressure increases, we could see movement to $3.08 and $3.29, which are the next resistance points.

However, if whale inflows continue to increase and the market faces more selling pressure, it is likely to drop back to $2.72. That level is the bottom of the recent trading range and a potential decline zone.

Currently, XRP remains within its range, but with whales selling and short-term buyers holding firm, this won't last long. The next movement will reveal who truly controls this market.