Welcome to the US Cryptocurrency Morning Briefing.

In recent weeks, as institutional interest in Ethereum has increased, even passionate Bitcoin supporters are on guard.

Ethereum, Reuniting Money and State

Wall Street's growing interest in Ethereum has received strong warnings from Bitcoin maximalists, especially Max Keiser.

As major players move to accumulate massive amounts of ETH, some industry veterans are concerned that Ethereum is taking on the role of a programmable tool for state-supported financial control.

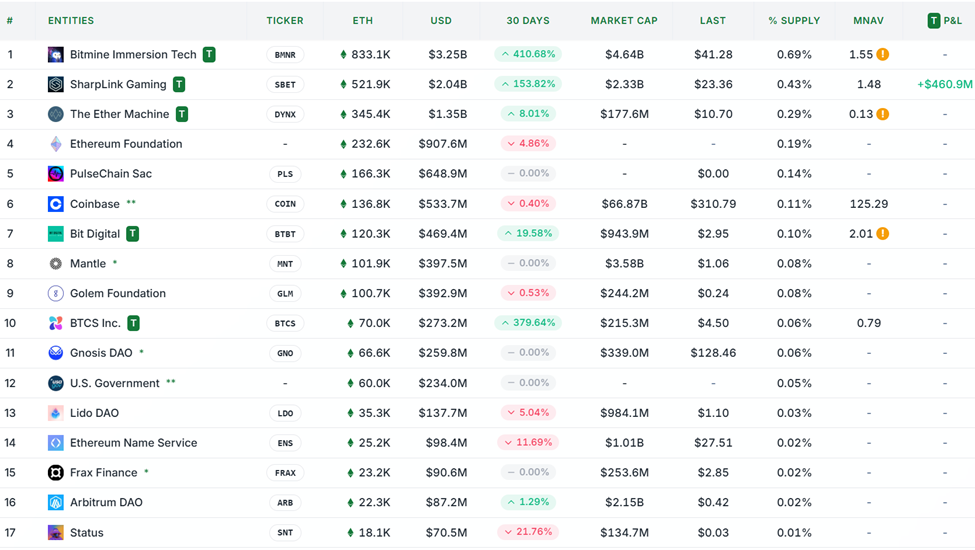

In a recent US cryptocurrency news publication, Tom Lee of Fundstrat announced through Bitmine a commitment to collect 5% of the total ETH supply.

Appreciate this @cosmo_jiang 😍😍😍

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) July 24, 2025

Pantera has been a great partner @PanteraCapital

Bitmine $BMNR is committed to rapidly growing ETH value per share

And the stated goal is eventually 5% of ETH https://t.co/IbCHfQxikU

The new institutional vehicle for Ethereum is reportedly accelerating faster than Michael Saylor's Bitcoin strategy. Beincrypto reported that Bitmine claims to have the largest ETH treasury, holding $2.9 billion in Ethereum.

According to Bankless, a tech podcast, Wall Street and possibly the US government are supporting Bitmine as a vehicle for Ethereum strategy. However, Max Keiser, El Salvador's Bitcoin chief advisor, was not impressed.

"The primary use case of Bitcoin is separating money from the state. Other fiat or cryptocurrencies do not do this," Keiser told Beincrypto.

The Bitcoin pioneer explained that BTC and other cryptocurrency treasury companies are moving in the opposite direction, integrating money and state.

"Investors should note that this adds immeasurable risk when compared to self-custodial Bitcoin," he mentioned.

Keiser implies that Bitcoin gives individuals the power to break free from central control. Meanwhile, Wall Street's Ethereum adoption signifies a return to traditional hierarchical structures, this time on-chain.

According to his view, the ETH-backed treasury strategy may seem novel but reintroduces systemic risks that cryptocurrency was designed to remove.

Meanwhile, Ethereum supporters see a different picture. To them, ETH's programmable nature, alignment with regulatory trends, and increasing use in real-world asset (RWA) tokenization make it a natural choice for institutions seeking compliant cryptocurrency exposure.

Nevertheless, Keiser's criticism touches on a deeper philosophical divide. Bitcoin supporters believe in decentralized sovereignty. Based on this, Ethereum's expanding institutional connections may seem to compromise that spirit in their eyes.

Today's Chart

US Cryptocurrency Key News

Summary of today's notable US cryptocurrency news:

- Why Trump's 401(k) Crypto Promotion Could Surpass Bitcoin ETF.

- Block stock surged by 10%. As Jack Dorsey's company expands Sailor coin trend.

- El Salvador to Establish a Bitcoin Bank – A First of Its Kind.

- Ethereum approached $4,000. Whale Selling and Binance Allegations Cause Uncertainty.

- Coinfund President Reveals Biggest Risk of Stablecoins and Suggests a Solution.

- Ripple's Legal Victory Opens Doors. Is BlackRock Ready to Make a Big Bet on XRP?

- Bitcoin Uptrend at Risk as Whales Sell and Retail Investors Buy Late.

- Bitcoin Miners Have Rebounded. MARA, Cipher, and Cango Increase Production in July.

- Binance and BBVA Partner to Enhance Cryptocurrency Custody Outside Exchanges in Spain.

- Vitalik Buterin Reveals What Could Go Wrong as Companies Dedicate to Ethereum.

Cryptocurrency Stock Pre-Market Overview

| Company | Closed on August 7 | Pre-Market Overview |

| Strategy (MSTR) | $402.01 | $400.60 (-0.35%) |

| Coinbase Global (COIN) | $310.79 | $313.55 (+0.89%) |

| Galaxy Digital Holdings (GLXY) | $28.09 | $28.40 (+1.10%) |

| MARA Holdings (MARA) | $15.95 | $16.02 (+0.44%) |

| Riot Platform (RIOT) | $11.58 | $11.63 (+0.43%) |

| Core Scientific (CORZ) | $14.35 | $14.49 (+0.95%) |