Overview

After a sharp retest of the sub-$114k air gap, Bitcoin’s spot price staged a strong rebound over the past week, climbing back toward $121k. This recovery brought momentum back into the market, with several sectors showing signs of renewed activity, though conditions warrant close monitoring.

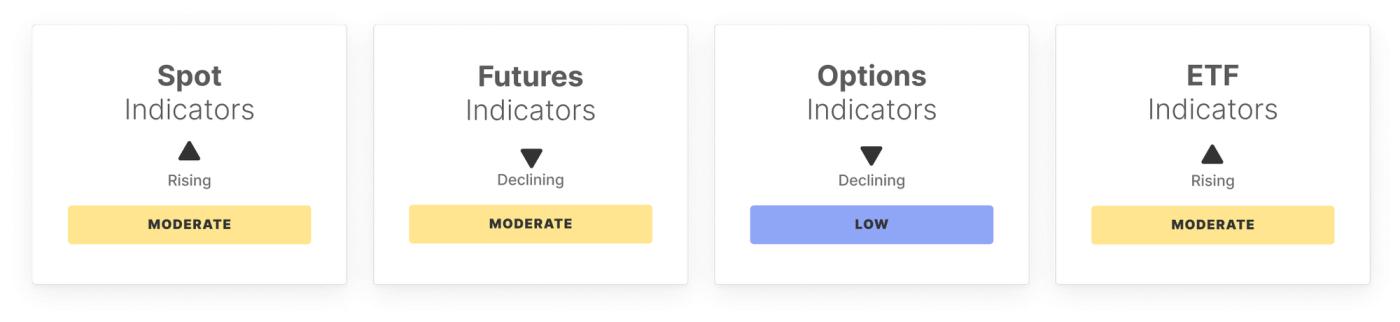

In the Spot Market, RSI rose from 41.5 to 47.5, bouncing from oversold territory, while Spot CVD improved sharply from heavy selling to near-neutral levels. However, spot trading volume dropped 22% to $5.7B, indicating that the recovery has yet to be matched by broad participation.

The Futures Market saw Open Interest ease slightly to $44.1B, with long-side funding slipping marginally yet remaining elevated. Perpetual CVD jumped to -$0.2B, signaling a notable shift toward buy-side aggression and renewed confidence among leveraged traders.

In the Options Market, Open Interest rebounded 6.7% to $42.4B, showing growing participation. The volatility spread contracted sharply to 10.45%, near its low band, suggesting complacent volatility pricing, while the 25 Delta Skew eased but stayed above its high band, reflecting lingering demand for downside protection.

The ETF Market recorded a sharp improvement in net flows, with outflows narrowing by over half, though trading volume fell 27.7% to $13.7B, near its low band. ETF MVRV rose above its high band to 2.43, signaling strong unrealized profits and potential profit-taking risk.

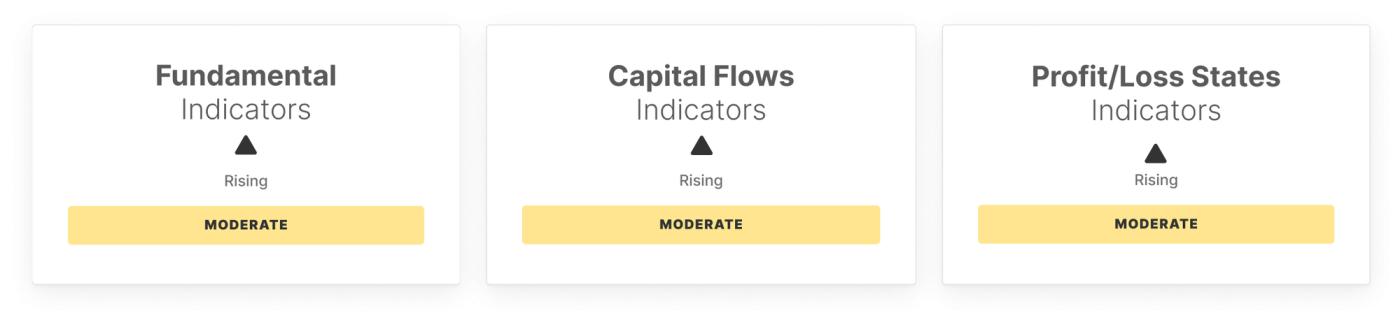

On-Chain Fundamentals strengthened, with active addresses climbing above their high band to 793k. Transfer volume held steady at $8.5B after prior declines, and fee volume rose 10.3%, reflecting increased demand for transaction inclusion.

Capital Flows moderated slightly as Realized Cap Change dipped to 5.2% but stayed above its high band. The STH/LTH ratio and Hot Capital Share remain stable, showing a balanced market structure and liquidity.

Profitability metrics improved, with Percent Supply in Profit at 94.1% and NUPL up to 8.5%. The Realized P/L Ratio rose to 1.9, highlighting profit-taking dominance.

In sum, the market has shifted from seller exhaustion to a strong rebound near recent ATHs. While momentum has returned, the move should be monitored closely, as elevated profitability and profit-taking potential could quickly alter sentiment.

Off-Chain Indicators

On-Chain Indicators

- Follow us and reach out on X

- Join our Telegram channel

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies.

Please read our Transparency Notice when using exchange data.