XRP has risen by almost 10% last week. This rally was supported by an improved sentiment across digital assets, with significant developments driving the upward momentum.

Leveraging this, institutional demand for XRP has surged. This strengthens the bullish sentiment among token holders and suggests the possibility of additional gains in the short term.

XRP Legal Victory Triggers Institutional Rush

On August 7th, a submission through the Second Circuit Court of Appeals acknowledged the joint dismissal of the SEC's appeal and Ripple's cross-appeal in the long-standing lawsuit against XRP. This submission concludes one of the most closely watched enforcement battles in cryptocurrency history.

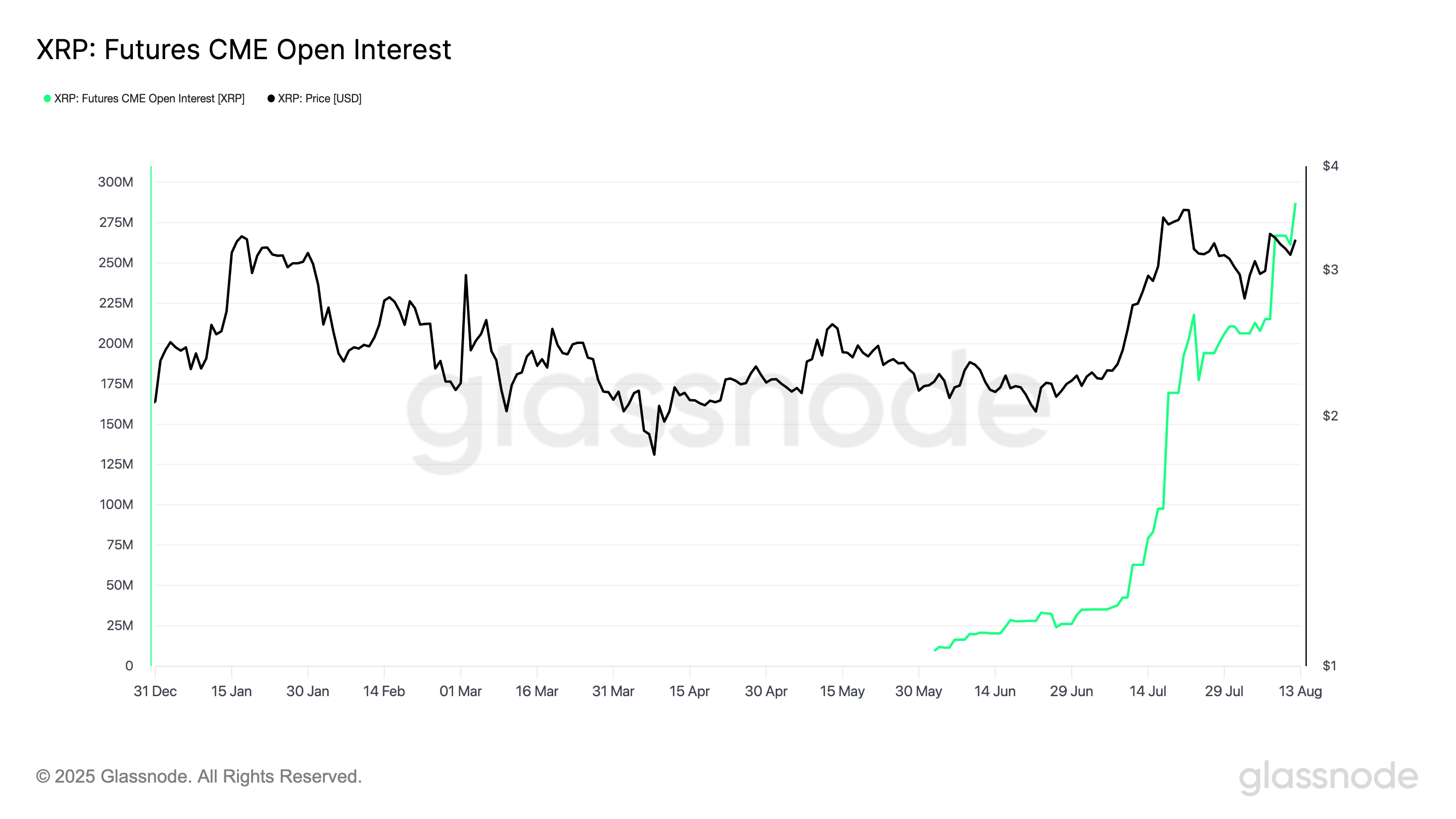

Following this development, retail demand for XRP has steadily increased, along with institutional interest. This is reflected in the increase in open interest for XRP futures contracts on the Chicago Mercantile Exchange (CME).

According to glassnode, this closed at an annual high of 287,200 XRP on August 12th, indicating increased participation from larger market participants.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harsh Notariya's daily crypto newsletter here.

XRP Futures CME Open Interest. Source: glassnode

The CME's XRP futures market is dominated by institutional investors seeking regulated exposure to the token. Therefore, the increase in open interest suggests these investors are actively increasing their positions. This can strengthen buying pressure and potentially increase XRP's upward momentum in the short term.

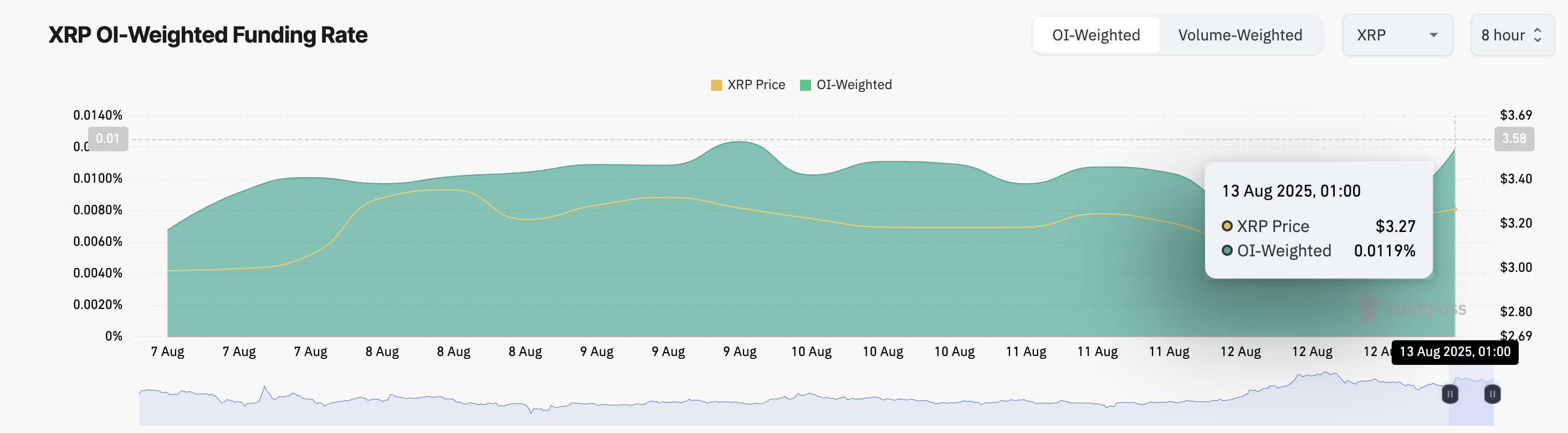

Moreover, XRP has consistently recorded a positive funding rate since June 28th, indicating that traders continue to pay a premium to maintain long positions. At the time of writing, this indicator is 0.0119% according to Coinglass data.

The funding rate is a periodic payment between traders in perpetual futures contracts to align the price with the spot market. When this value is positive, long position holders are paying short positions, indicating that most traders anticipate further price increases.

XRP Could Reach 3.66 if Breaking 3.33

XRP, which rose 3% in the past day, is currently trading at $3.22. If demand strengthens, XRP could extend its price rise to $3.33. Successfully breaking this barrier could open the way to move near $3.66.

However, if sellers regain control, the XRP price could drop to $2.99.