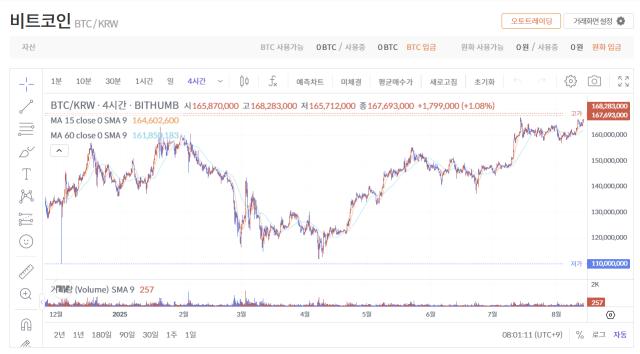

Bitcoin price has entered an uncharted territory, recording a new all-time high surpassing $124,000. BTC rose almost 8% last week.

This movement occurred as on-chain changes worked favorably for the upward trend. Aggressive buying in perpetual futures has been building up for days. This time, Bitcoin price may aim for targets higher than its current all-time high.

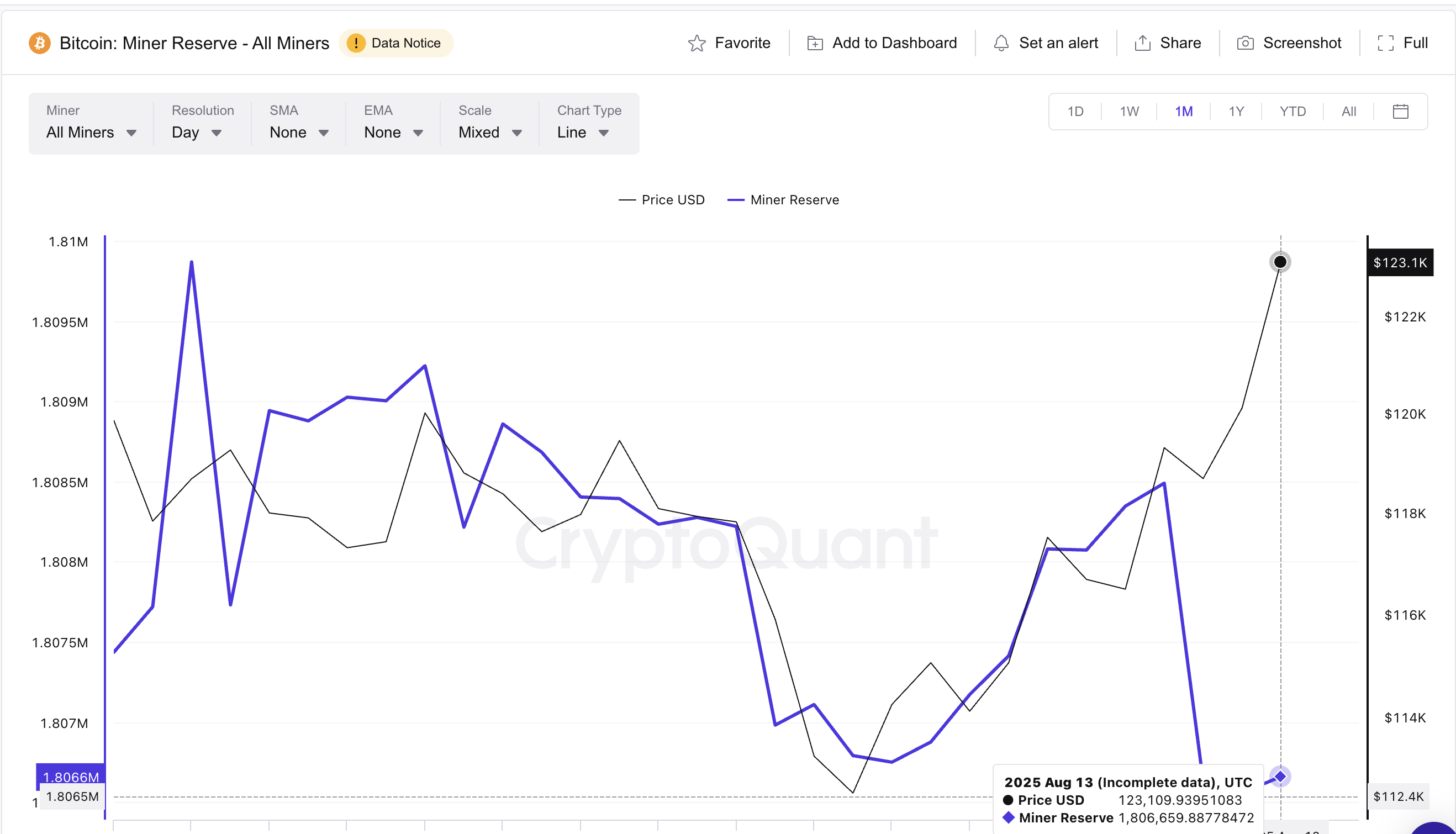

Miner Holdings Decrease... Selling Pressure Eases

Early this month, miner holdings increased from 1,806,790 BTC on August 2nd to 1,808,488 BTC on August 10th. This raised the risk of supply fluctuations in the market. This increase reflected higher selling pressure from miners, which is often considered a headwind for a rally.

Over 2,000 Bitcoin $BTC sold by miners in 3 days! pic.twitter.com/2DZdu3YaZ3

— Ali (@ali_charts) August 12, 2025

However, as Bitcoin price attempted to break through, holdings decreased to 1,806,630 BTC and then stabilized. This indicates that the immediate selling risk has been mitigated. This change provided an opportunity to push the market higher without massive miner sales.

Miner holdings: Total BTC held by miners. An increase in holdings can signal selling pressure, while a decrease can remove major supply-side threats.

Token Technical Analysis and Market Update: Want more such token insights? Subscribe to the daily crypto newsletter by editor Harsh Notariya here.

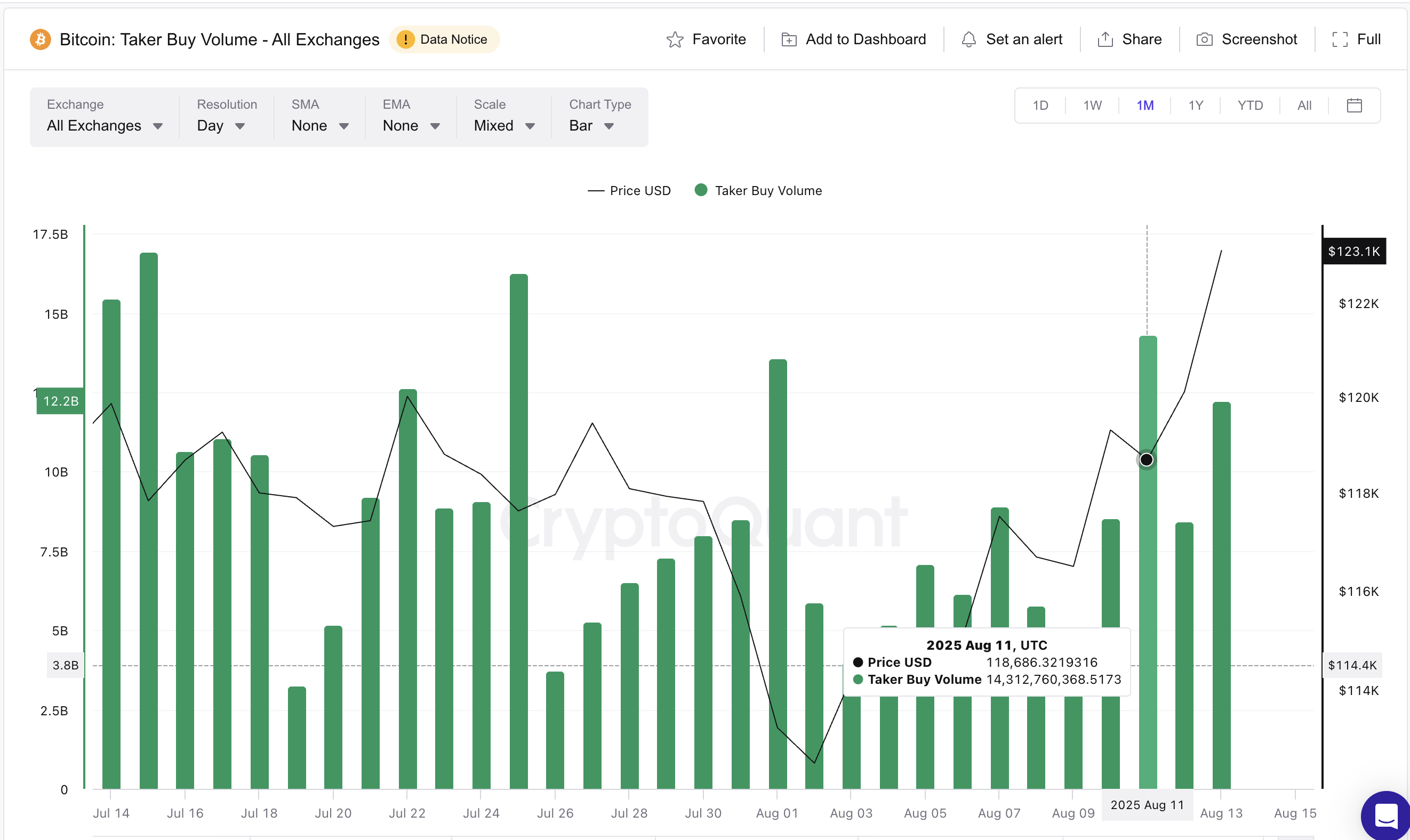

Buyer Volume, Bull Market Ready

Buyer volume; the total nominal value of market buy orders removing sell-side liquidity surged to $14.31 billion on August 11th.

The key point here is that for market buy orders to be executed, they must "hit" existing sell orders in the order book. Thus, buyers are immediately buying at sellers' prices without waiting for a dip or a better trade.

In other words, high buyer volume means aggressive buyers are removing sell-side liquidity from the order book. This can quickly eliminate sellers and push prices higher.

This indicator remains at $12.24 billion, showing traders are still buying without waiting for a dip.

Historically, such sustained buy-side attacks often herald a successful breakout. In this case, it was more about when the rally would break through rather than if it would.

Bitcoin Price Levels to Watch

Current momentum is heavily tilted towards the upside, with an immediate test at $124,300. This is the last major barrier before higher targets are realized.

Breaking and closing above this level could open the Bitcoin price path to $127,600. This aligns with the 1.0 Fibonacci extension and represents the next major upside target.

Conversely, if Bitcoin fails to maintain above $121,600, especially if miner holdings rebound, the uptrend setup could experience a larger correction.