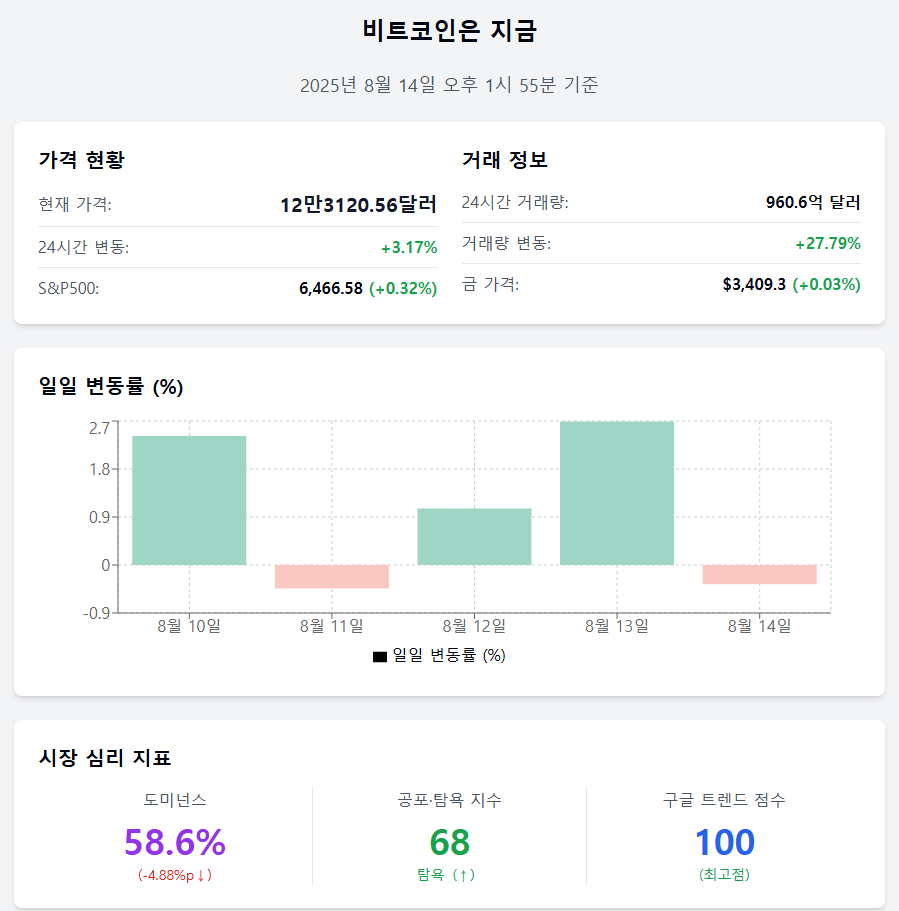

As of August 14, 2025, 1:55 PM

Bitcoin continues its short-term rebound, surpassing the $120,000 mark, but with a significant drop in dominance, exchange net outflows, and improving investment sentiment, the trend of funds moving to altcoins is becoming increasingly clear.

📈 Price now

Price $123,120.56 (+3.17%) Bitcoin is trading at $123,120.56, up 3.17% from the previous day. The short-term rebound trend is strengthening, testing the psychological resistance line.

Trading volume $9.606 billion (+27.79%) The 24-hour trading volume has increased by 27.79% to $9.606 billion, with simultaneous expansion of short-term investor and institutional fund inflows.

Daily volatility –0.36% Over the past 5 trading days, the daily volatility has been 10th +2.42%, 11th –0.44%, 12th +1.06%, 13th +2.69%, 14th –0.36%, showing a trend of limited adjustments within an upward movement.

Asset comparison S&P500↑ · Gold↑ As of the 13th, the S&P500 index rose 0.32% to 6,466.58, and gold price increased slightly by 0.03% to $3,409.3. Both risk and safe-haven assets showed strength.

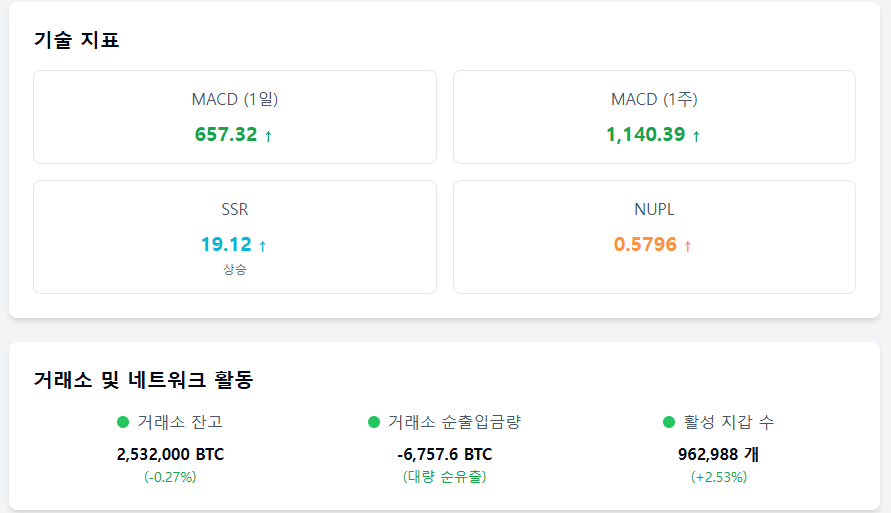

MACD 657.32 The short-term MACD is 657.32, expanding upward momentum, and the 1-week MACD is 1,140.39, maintaining a medium-term bullish trend.

❤️ Sentiment now

Dominance 58.6% (–4.88%p) Bitcoin dominance has dropped 4.88 percentage points, making the fund movement to altcoins even more apparent.

Fear & Greed Index 68 (Greed) Increased from the previous day (63, Greed) and maintaining the greed zone. Compared to last week (54, Neutral), investment sentiment shows a clear recovery.

Google Trend 100 (Preliminary) Bitcoin-related search scores jumped from 74 on the 13th to 100 on the 14th, significantly expanding interest.

🧭 Market now

SSR 19.1183 (+0.5144) The Stablecoin Supply Ratio (SSR) is 19.1183, up from 18.6039 the previous day, indicating relatively higher Bitcoin value. Short-term buying capacity may be more limited.

NUPL 0.5796 (+0.0107) The Unrealized Profit Ratio is 0.5796, up 0.0107 from the previous day, expanding the proportion of investors in the profit zone.

Exchange balance 2.532 million BTC (–0.27%) Exchange Bitcoin holdings decreased by 0.27% to 2.532 million BTC, showing a trend of reduced short-term selling inventory.

Exchange net inflow/outflow –6,757.6 BTC (+8.86%) The exchange net inflow/outflow is –6,757.6 BTC, increasing by 8.86% from the previous day, continuing Bitcoin net outflows.

Active wallets 962,988 (+2.53%) Active wallet count increased by 2.53% from the previous day (939,311) to 962,988, indicating more active on-chain activity.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>