Bitcoin (BTC) reached a new all-time high today during early Asian trading hours, surpassing $123,700. This triggered a strong momentum across the cryptocurrency sector.

Moreover, many experts suggest that additional BTC appreciation may be imminent. They predict Bitcoin could continue rising due to its positive correlation with gold.

What's Next for Bitcoin? Gold-BTC Correlation... Hints of Further Appreciation

In a recent X (formerly Twitter) post, Charles Edwards, founder of Capriole Investments, pointed out the widening gap between gold and Bitcoin. According to his analysis, Bitcoin tends to narrow this gap over time.

Edwards observed that the current gap is similar to what was observed in 2020, which led to Bitcoin entering a strong bullish market.

Furthermore, until 2021, Bitcoin outperformed gold. Therefore, if history repeats itself, this representative coin is likely to reach new heights beyond its current record peak.

Similarly, cryptocurrency investor Jelle reinforced this narrative. He emphasized that gold typically leads and Bitcoin follows. Jelle predicted that this dynamic relationship could drive Bitcoin to $150,000.

$GLD and $BTC correlated to each other last 3 years.

— Heisenberg (@Mr_Derivatives) August 13, 2025

Don't fight brothers.

OWN BOTH!

With that said, Gold looks ready again… pic.twitter.com/zk3bSXXFAi

Reasons for Continued Bitcoin Appreciation

Expectations of rising Bitcoin or gold prices are not unreasonable given current market conditions. Charlie Bilello, senior market strategist at Creative Planning, previously stated that gold and Bitcoin are the top-performing assets in 2025.

"Gold (+29%) and Bitcoin (+25%) are the top-performing major assets so far in 2025." – Charlie Bilello

He emphasized that gold and Bitcoin have never occupied the top two spots in any year, noting 2025 as a remarkable exception. Additionally, in a detailed X thread, Cobayashi Letter explained that BTC and gold are benefiting from multiple factors.

The market commentator mentioned that US tariff revenue surged over 300% in July 2025, reaching $29.6 billion. Cobayashi Letter anticipates annual revenue exceeding $350 billion during the Trump presidency.

Nevertheless, the US deficit increased by $47 billion (19%) in July, with government spending reaching $630 billion. Meanwhile, tariff revenue covered only about 10% of the deficit.

"Despite record tariff revenue, the US spent almost twice what it received in July. If spending could be reduced, Trump's tariffs could significantly help reduce the deficit. The current gap is too large." – Cobayashi Letter

This economic backdrop increases investor interest in gold and Bitcoin amid financial instability and inflation pressures.

"As we've been saying for over 12 months, this is the best fundamental backdrop for both gold and Bitcoin." – Cobayashi Letter

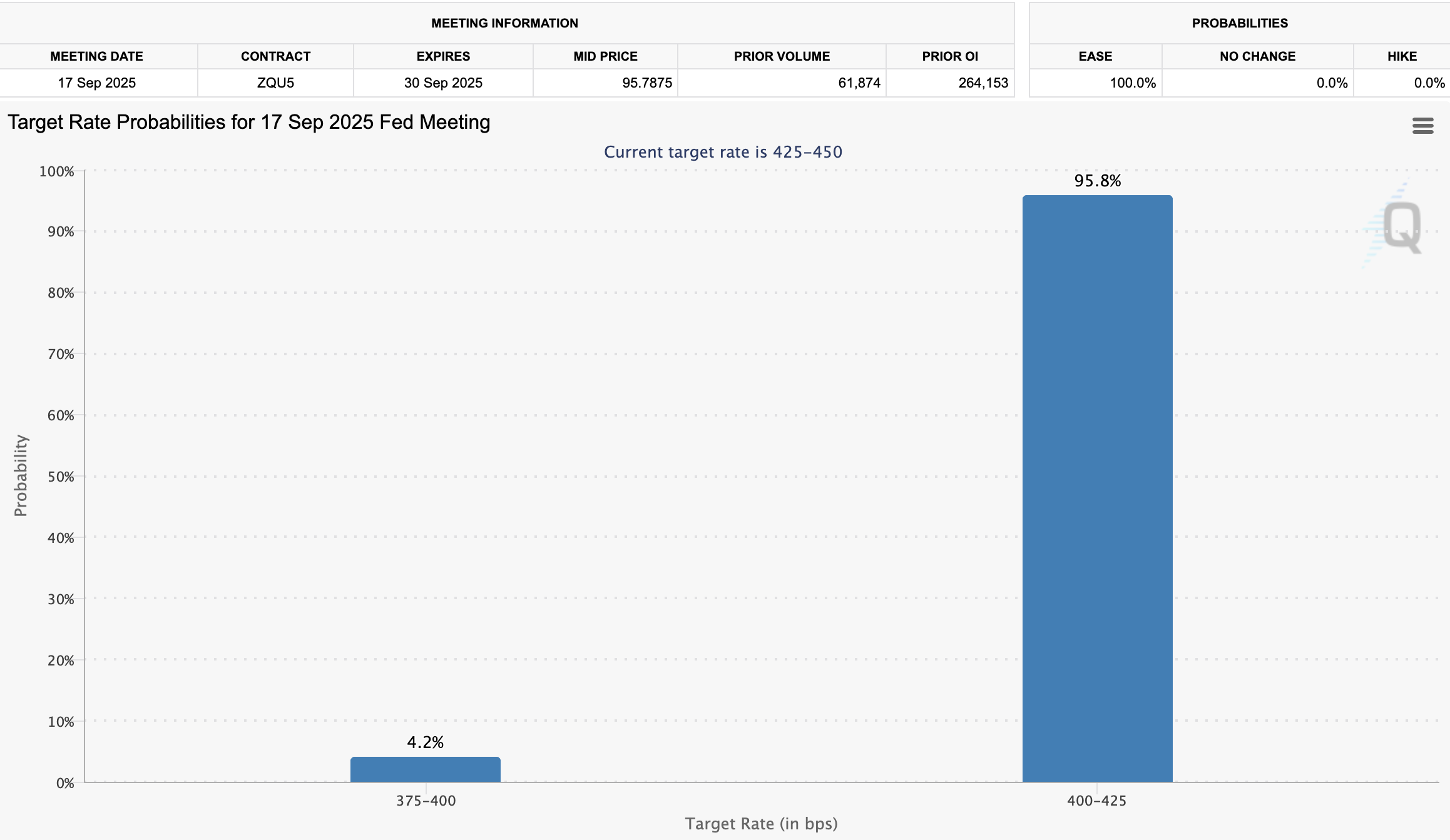

Furthermore, the latest data from the CME FedWatch tool shows the probability of a Fed rate cut in September has sharply risen to 95.8%.

BeInCrypto previously reported that a Fed rate cut could be highly positive for cryptocurrencies. Therefore, the gold-BTC correlation and other macroeconomic factors suggest Bitcoin's rise is not over. The market will carefully watch how far assets will go.