After recording a new all-time high of $122,920 on Monday, Bitcoin's price is showing a sideways trend, with market momentum slowing down.

This quiet price movement is occurring as many traders realize profits following the recent surge, and on-chain indicators suggest a decrease in interest from US investors.

BTC Price Surge Stops...US Investors Retreat

According to on-chain data, trading activity among US participants has significantly decreased over the past week. This increases the risk of a long-term correction phase or short-term adjustment.

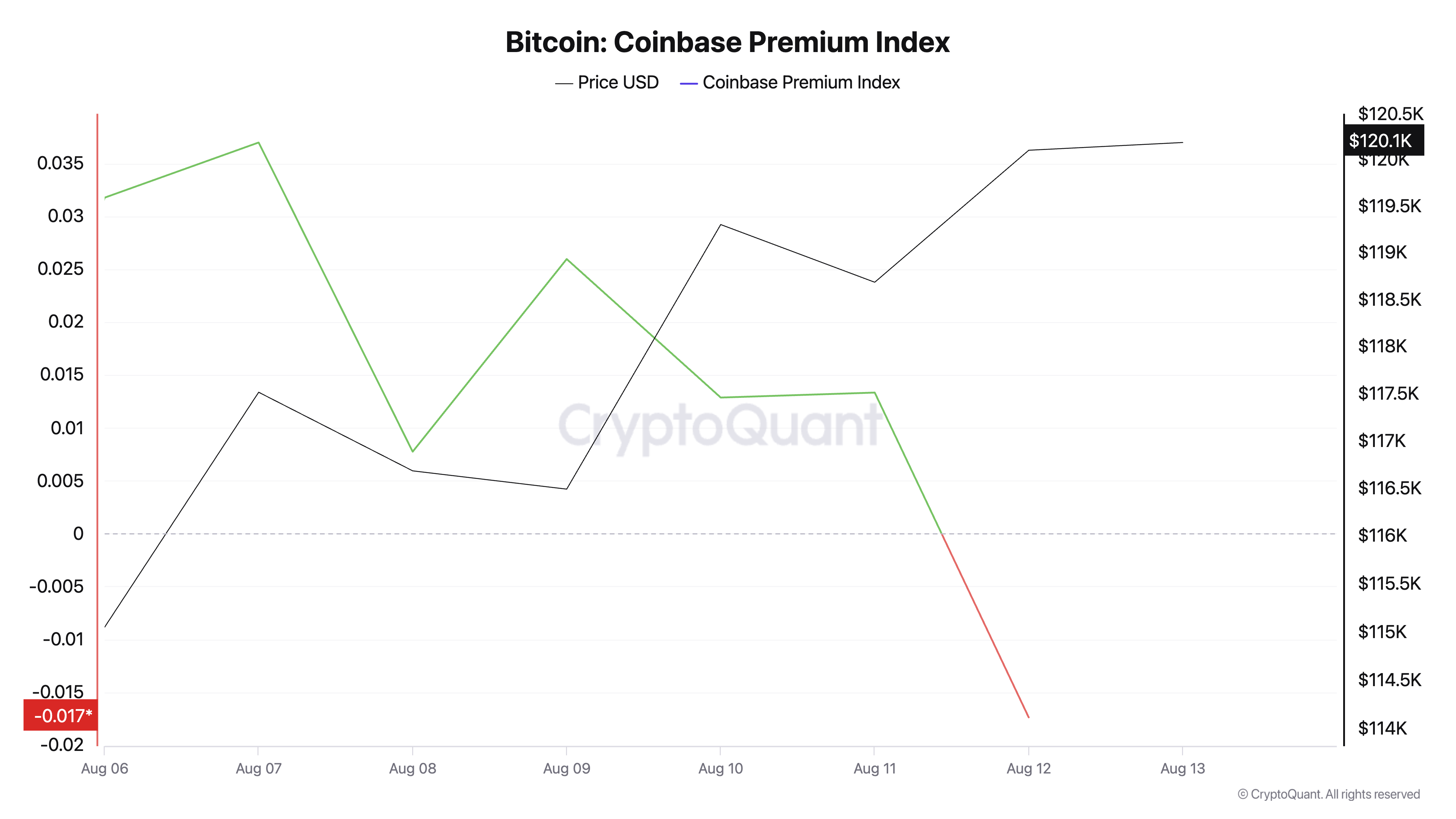

Data from CryptoQuant shows that Bitcoin's Coinbase Premium Index (CPI) has been steadily declining over the past week, indicating reduced buying interest from US investors.

According to the data provider, it closed at a low of -0.017 yesterday.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harshi Notariya's daily crypto newsletter here.

This indicator measures the price difference of Bitcoin between Coinbase and Binance, providing a reliable gauge of US investor sentiment.

When the CPI rises, Bitcoin trades at a premium on Coinbase compared to international exchanges, indicating strong buying pressure from US investors.

Conversely, when it falls or turns negative, it suggests that demand on Coinbase is lagging behind the global market, due to profit-taking or decreased interest from US buyers. This is currently ongoing and may contribute to the coin's sideways movement following the recent high.

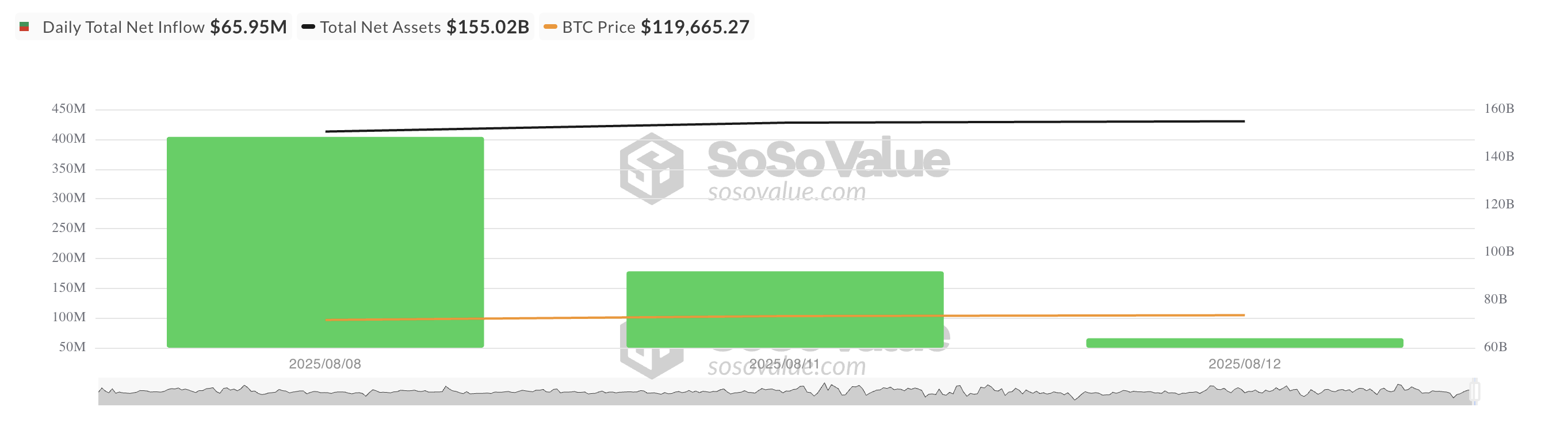

This cooled sentiment is also reflected in the decreased spot ETF inflows for Bitcoin since the beginning of this week.

According to SosoValue data, Bitcoin-based funds have maintained positive net inflows since Monday, but the volume of these inflows has been steadily decreasing.

This indicates a slight but noticeable retreat in institutional participation.

$118,000 as the Floor, $122,000 as the Ceiling?

This trend suggests that the aggressive buying wave seen during Bitcoin's recent rally is losing momentum. If this continues, Bitcoin could extend its decline to $118,851.

However, if sentiment improves among US investors and they increase coin accumulation, Bitcoin's price could resume its upward trend and revisit its all-time high.