A new study by Satoshi Action Education predicts that there is a 75% probability that Bitcoin will exceed $4.81 million by April 2036.

Led by economist Murray A. Rudd, this research investigates how supply constraints and institutional demand can impact long-term valuation using an updated probability model.

Supply Shock Scenario... Bitcoin Price

The updated results show a 75% probability of exceeding $4.81 million by April 2036. The 25% over band reaches $10.22 million, and the 95% upper limit ranges between $11.89 million and $14.76 million depending on simulation parameters. In the most extreme 1% of simulations, the peak approaches $50 million. The median estimates are around $6.55 million to $6.96 million for the same date.

Bitcoin's 21 million supply limit and approximately 3 million BTC in floating supply fix the supply side. Long-term storage, corporate collateralization, DeFi activities, and Layer 2 networks are expected to further reduce tradable supply. The base and intermediate scenarios maintain floating supply between 6.55 and 6.96 million BTC by April 2036, mitigating extreme predictions.

Stress path simulations show that continuous exchange withdrawals can accelerate scarcity. If circulating liquid supply drops below 2 million BTC and contraction sensitivity is low, the model shows prices could surge. In the worst 1% depletion path, floating supply drops below 2 million BTC by January 19, 2026, and below 1 million BTC by December 7, 2027.

The updated model predicts significantly higher prices than the January report, using conservative adoption and liquidity assumptions. Researchers explain this is due to supply-demand imbalances and structural constraints limiting available supply after 2026. The model integrates institutional accumulation patterns, reducing purchases during rallies and increasing them under stable conditions.

The study mentions that investors' awareness of liquidity risk will be essential as adoption increases. It emphasizes a narrow margin between sustainable scarcity and unstable depletion, which could lead to excessive volatility.

Portfolio Strategy Implications

These findings impact portfolio strategies and policies. For long-term allocators, the steep right tail of the price distribution supports strategies that respect liquidity constraints while considering asymmetric upside. Policymakers may need to address custody concentration and cross-border capital flows as corporate finance, sovereign reserves, and tokenization initiatives pressure circulating supply.

Combining macro adoption curves with micro liquidity events, the Monte Carlo framework and Epstein-Zin utility specification provide a more comprehensive perspective than simpler predictive models. Multiple constraints are integrated to simulate how Bitcoin's price might evolve under various market and policy conditions.

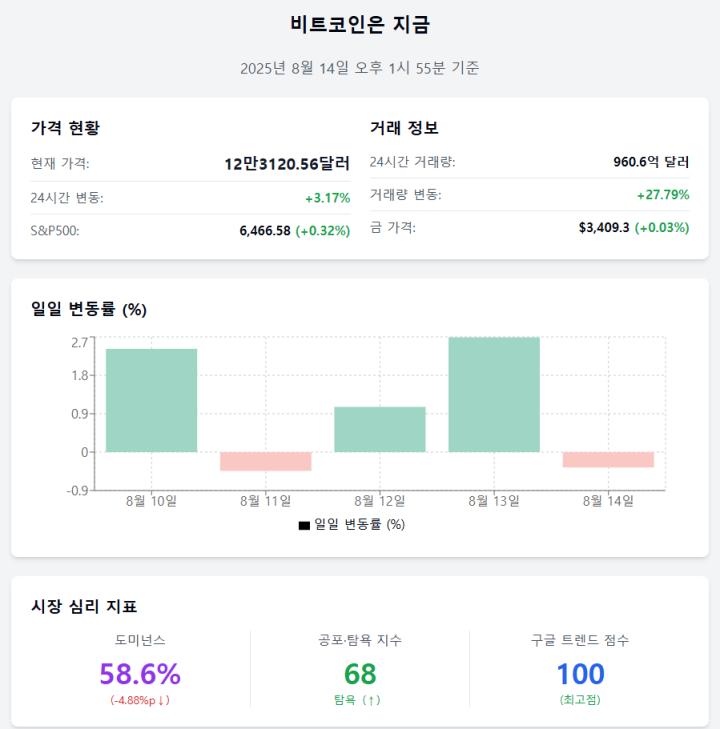

According to BeInCrypto, Bitcoin entered uncharted territory on Thursday, breaking through $124,000 and setting a new all-time high. The price rose nearly 8% last week. Analysts point to a convergence of bullish on-chain signals suggesting the rally still has room to continue.