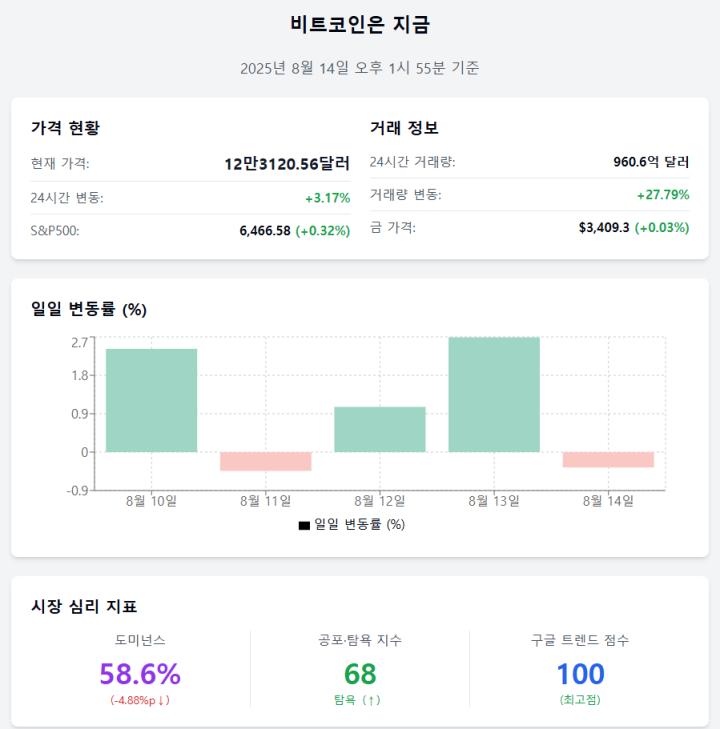

Bitcoin recently recorded a new all-time high (ATH) of $124,474, then declined by 3.5% over the past 24 hours.

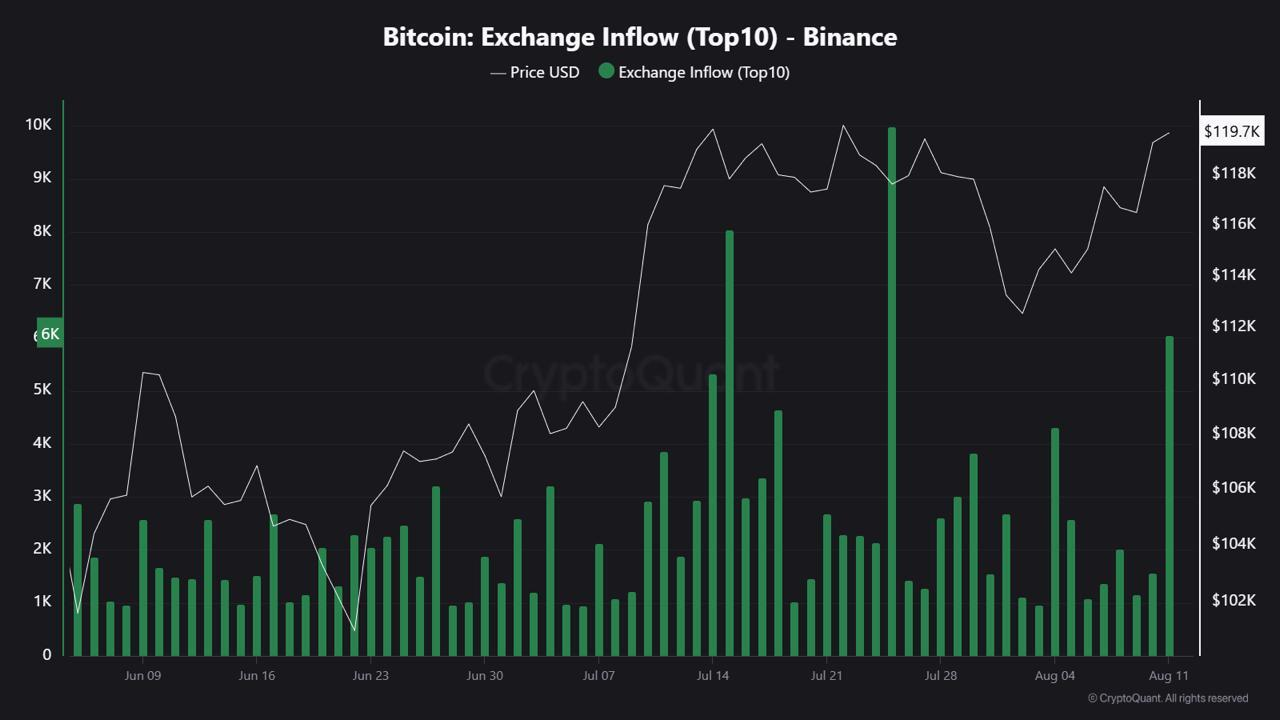

This decline follows a trend observed by CryptoQuant data. Whales (large holders) may be selling their positions. Selling activity is directly impacting Bitcoin's price at the ATH.

Bitcoin Whales Realizing Profits

Over the past 24 hours, Binance has seen a surge in Bitcoin deposits. 6,060 BTC, approximately $722 million, was added to the exchange's balance. CryptoQuant's data shows this surge primarily originated from whales.

CryptoQuant analyst JA Martoon mentions that recent economic reports, US unemployment claims, PPI, and retail sales are influencing whale behavior.

"This is likely a response to price increases and positioning ahead of economic events this week," Martoon told BeInCrypto.

The increase in Bitcoin balance on Binance suggests whales are taking action amid uncertain economic data. Such actions can negatively impact price, as large transactions often indicate psychological shifts.

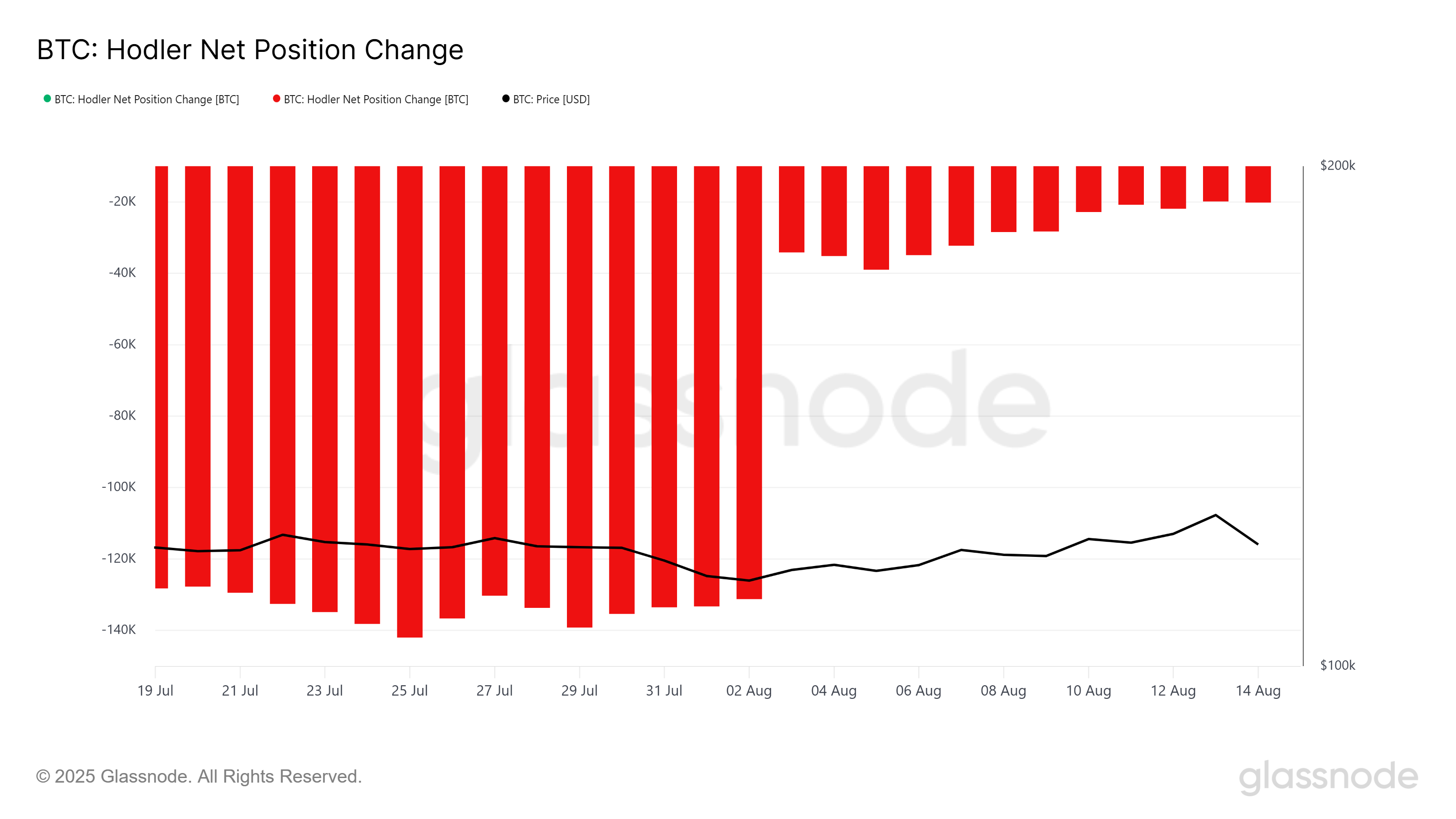

HODLer Net Position Change is a key indicator tracking long-term holder (LTH) behavior. Recent HODLer Net Position Change indicates decreasing selling pressure and moving out of the downtrend area.

This change in HODLer behavior is a positive signal. It suggests major Bitcoin holders are maintaining their positions. Despite the recent ATH and subsequent decline, LTHs are holding strong. This can stabilize the market and support potential recovery. Resistance to selling could ultimately contribute to movement towards higher price levels like $122,000.

BTC Price Holding

Bitcoin is currently trading at $119,186 after falling below the key $120,000 level. The price showed volatility, declining from the recent ATH of $124,474. Despite this decline, Bitcoin maintains support above $119,000, suggesting the recent drop might be a short-term correction.

Considering mixed market sentiment, Bitcoin could recover $120,000 as a solid support level. If buying pressure can maintain this level, Bitcoin might recover from the recent decline and move towards $122,000.

However, if selling pressure intensifies, Bitcoin's price could break through the $117,261 support level and decline further. A deeper drop could pull the price below $115,000, which would invalidate the bullish outlook and indicate additional market weakness.