Pi coin price rose by 5.5% last week, outperforming XRP, BCH, TRON, and Uniswap. However, due to the overall downward trend, investors are raising questions.

A new mindset has emerged, placing its price behavior on par with coins in the popular cryptocurrency sector. This could be a change that redefines the short-term outlook.

Pi Coin Similar to Major Meme Coins

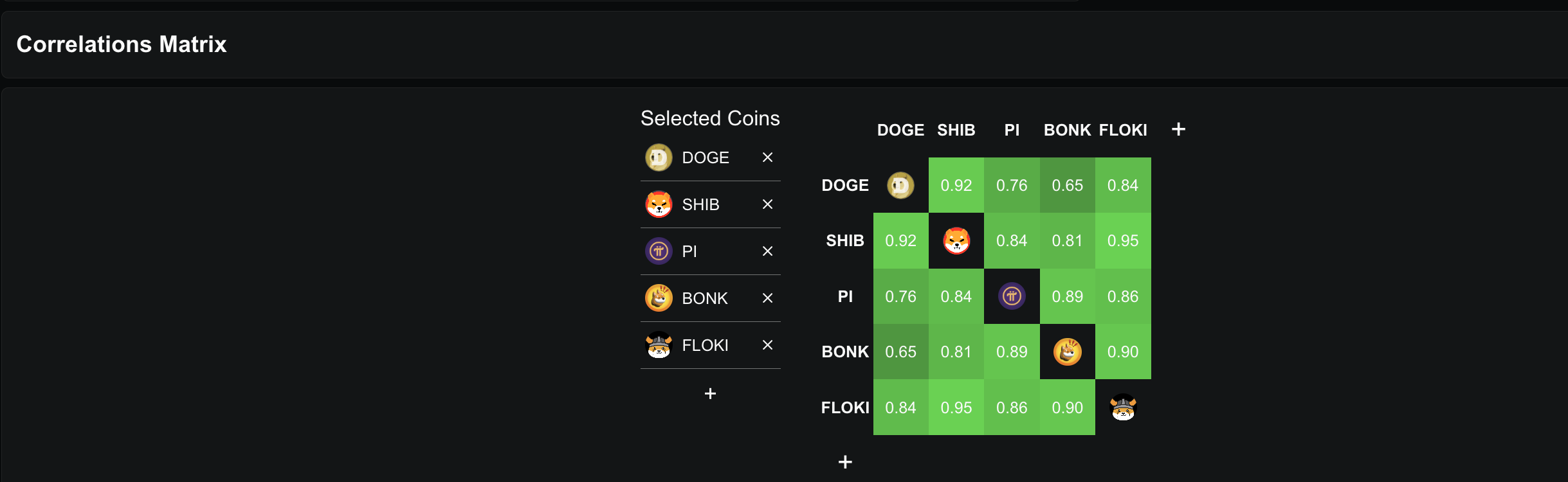

According to the latest monthly correlation data, PI's market behavior has significantly changed. It now has a correlation of 0.76 with Dogecoin, 0.84 with Shiba Inu, 0.89 with Bonk, and 0.86 with FLOKI. These figures firmly place PI in the meme coin volatility category, suggesting that the sector's rises and corrections can more easily impact Pi coin price.

If meme coins start to rise again, PI could ride that momentum. Conversely, if the sector cools down, PI could quickly decline due to its recent alignment, with meme coin sentiment becoming the most critical short-term factor in Pi coin's direction.

The Pearson correlation matrix shows how strongly different variables move together. The Pearson correlation coefficient ranges from -1 to +1. A value close to +1 means two variables mostly move in the same direction, a value close to -1 means they move in opposite directions, and a value close to 0 indicates almost no linear relationship. In cryptocurrency analysis, it is often used to measure how closely a coin's price movements track or differ from other coins.

Token Technical Analysis and Market Update: Want more such token insights? Subscribe to the daily crypto newsletter by editor Harsh Notariya here.

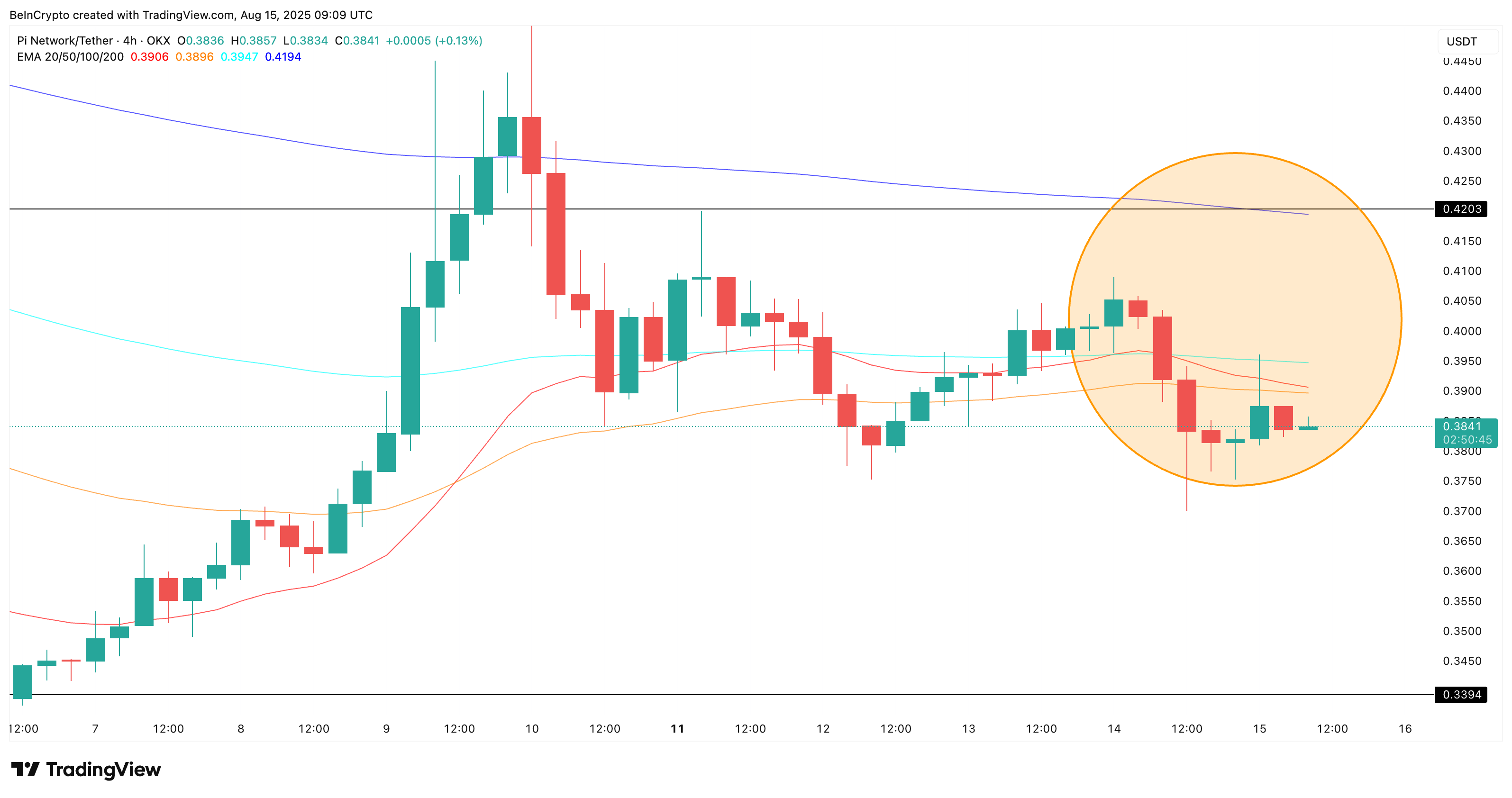

4-Hour Chart Technical Risk Increases

Pi coin's rising correlation now means it could be more exposed to sector-wide movements. The meme coin market has been under pressure in recent days, and if this weakness continues, Pi coin could also decline.

On the 4-hour chart, the 20-period EMA (orange line) is about to cross below the 50-period EMA (red line). This is known as a death cross pattern. If this crossover is confirmed and meme coin sentiment is negative, selling pressure could accelerate and the current correction could deepen.

Exponential Moving Average (EMA) is a type of moving average that gives more weight to recent price data, making it more sensitive to short-term price movements compared to Simple Moving Average (SMA).

Pi Coin Price Forms Bullish Divergence

The connection between Pi coin and meme coins suggests that a recovery in that space could influence PI's price behavior.

On the daily chart, the token shows a clear bullish RSI divergence. The price created a lower high, but the RSI recorded a higher high. The RSI is around 43.71, and crossing above 47 would confirm a new higher high, strengthening the bullish case.

If meme coins start to rebound, their momentum could be the catalyst needed for Pi coin. This could help PI recover to $0.39 and retest $0.41 to $0.43. Until then, the setup is not confirmed, and the 4-hour death cross risk still looms like a shadow over the chart.

A drop below $0.37 would not only invalidate the divergence but also make Pi coin more vulnerable, especially if the correlated sector continues to decline. The price chart still shows signs of strength. However, the sector's trend will determine whether it breaks through to dominance or fades away with the rest of the market.